Accurate medical billing makes sure that doctors get paid for their work, which allows for good healthcare management. Insurance claims and payments that are late can make the process more difficult. A lot of medical claims are either held up or rejected, which can affect a practice’s cash flow. The Aging Report in Medical Billing helps medical offices keep track of their money.

Aging reports show late payments, with 40% of medical claims unpaid after 120 days. This data helps practitioners prioritize collections and organize revenue cycles. Inefficiencies in managing outstanding claims can cost the typical practice $125,000 per year, making aging reports essential to financial health.

This blog highlights the Aging reports, Aging in Medical Billing, an important financial tool for healthcare firms. Aging Reports track on missing payments assist practitioners track delayed claims and revenue cycle difficulties.

What is an Aging Report in Medical Billing?

Aging Report in medical billing sorts unpaid bills and claims into groups based on when they are due. It helps healthcare providers keep track of and handle Accounts Receivable by showing what is past due, so they can follow up on time and stop revenue from leaking out. The report is mostly about insurance claims and helps people find delays from insurers and move quickly.

Structure of an Aging Reports

The aging report is typically divided into time-based categories, such as:

0–30 Days: Newly billed claims or invoices, likely within the normal processing timeframe.

31–60 Days: Claims that require follow-up to confirm receipt or resolve minor issues.

61–90 Days: Potential red flags indicating delays that need immediate attention.

90+ Days: Critical claims often at risk of being written off without urgent resolution.

An aging report helps improve financial performance and ensure timely collections by categorizing accounts receivable.

What Is an Insurance Aging Report?

Insurance aging Reports on insurance claims that haven’t been paid keep track of how long they’ve been unpaid. It helps healthcare providers keep track of late reimbursements, find problems with claim handling, and decide which insurance company follow-ups to do first. Regularly reviewing the aging report leads to better cash flow, claim rejections, and revenue cycle management.

Based on negotiated fee schedules with healthcare providers, insurance companies define contractual adjustments. These schedules determine payment levels for services under specific plans, based on the insurer, policy, and healthcare provider agreement.

Why is an Aging Report Useful?

Healthcare providers and billing professionals need accounts receivable aging reports. It helps practices maintain financial health and optimize revenue cycle management by providing a complete snapshot of outstanding claims and payments.

Aging Report Is useful because:

Tracking Outstanding Claims and Payments

The aging report ranks unpaid claims by duration. This segmentation helps practices prioritize follow-ups by claim age, ensuring older claims are addressed quickly. Timely follow-ups prevent denials and reimbursement delays, ensuring cash flow.

Identifying Bottlenecks in Collections

Aging reports can reveal collections issues such claims submission problems, payer processing delays, and billing team inefficiencies. These bottlenecks can be fixed to streamline billing and improve recovery rates.

Helping forecast and manage cash flow

Aging reports estimate claim payment timelines to predict future income. This data helps practitioners forecast revenue and allocate resources. A healthy cash flow ensures the practice’s growth and viability.

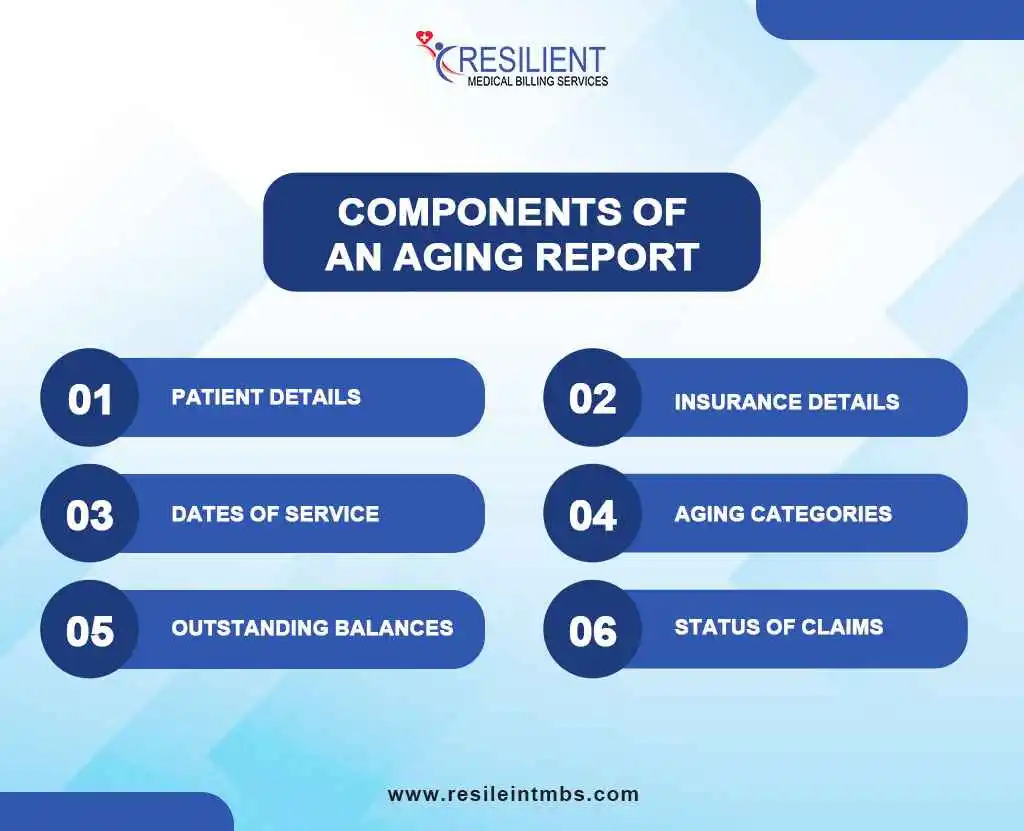

Components of an Aging Report

An aging report in medical billing is a comprehensive document containing critical data points that help track and manage outstanding claims. The key components include:

1. Patient Details

Accurate patient information, including name, ID, and contact details, ensures proper claim identification and follow-up communication.

2. Insurance Details

Details such as payer name, policy number, and coverage information are crucial for resolving issues with insurance companies efficiently.

3. Dates of Service

The date of service is essential for determining claim age and categorizing it appropriately. It helps prioritize claims based on how long they’ve been pending.

4. Aging Categories

Aging reports typically divide claims into categories like 0–30 days, 31–60 days, 61–90 days, and over 90 days. This segmentation aids in identifying patterns and focusing efforts on the most critical claims.

5. Outstanding Balances

A clear record of the total amount due for each claim helps practices understand the financial impact of outstanding payments.

6. Status of Claims

Details on the status—whether the claim is pending, under review, or denied—help prioritize follow-up actions effectively.

Benefits of Using Aging Reports in Medical Billing

In medical billing and revenue cycle management, aging reports are essential. Aging Report in medical billing classifies unpaid accounts receivable by length of time, revealing a practice’s financial health. Some important benefits are:

Follow ups of the health insurance claims

Of aging reports, the most useful type is the one that shows accounts which are overdue thus helping the healthcare providers to prioritize collections for follow up. Practices paying claims in a timely manner will help to eliminate or at least minimize long delayed claims and thus maintain good cash flow.

Reduced Revenue Loss

Aging reports are helpful to minimize cases of cash loss since unpaid accounts are discovered as early as possible. This assists providers in taking the right action including resubmission of claims and or notifying patients and insurance companies.

General Financial Improvement

By clarifying accounts receivable the aging report helps healthcare practices stay financially stable. They provide payment behavior data to help service providers predict income and make business decisions.

Tips for Effective Aging Report Management

Regular Reviews: Conduct weekly or bi-weekly reviews and updates to track overdue accounts and reflect recent payments.

Expert Collaboration: Partner with medical billing professionals for timely follow-ups and compliance.

Use Technology: Leverage automation and analytics to improve accuracy and optimize revenue management.

The Bottom Line

Aging Report in medical billing is essential for financial stability and operational efficiency in this constantly changing healthcare. They help providers boost claim follow-ups, cut revenue leakage, and improve financial health.

In order to enhance aging report benefits, healthcare professionals should incorporate regular assessments, interdisciplinary cooperation as well as technologies.

For medical billing process optimization, contact Resilients MBS (Medical Billing Solutions). We can assist you improve revenue cycle management and manage your finances. Contact us today.