Healthcare organizations need financial stability more than ever in the modern world. About 9% of healthcare claims are initially denied, costing providers $25 per claim to rework. Additionally, 65% of denied claims are never resubmitted, resulting in significant revenue loss.

Effective denial management is identifying, assessing, and resolving denied insurance claims is key to addressing these issues. Healthcare institutions can recover income and enhance financial health by immediately addressing denials. In this blog we are going to discuss How can effective management of denials can improve pratice’s revenue cycle and sustainability.

What is revenue cycle management (RCM)?

Revenue cycle management involves patients registration, fee billing, coding, claims submission and receiving of payments. When you have a robust RCM system implemented, the process is accurate and effective and claims are not easily denied.

Understanding Denial Management

Denial management involves analysing refused insurance claims, identifying causes, and taking corrective steps to recover money. This proactive approach to healthcare denials management prevents future claim denials and optimizes financial outcomes.

Common Causes of Claim Denials

- Coding Errors

- Missing Documentation

- Patient Eligibility Issues

- Authorization Challenges

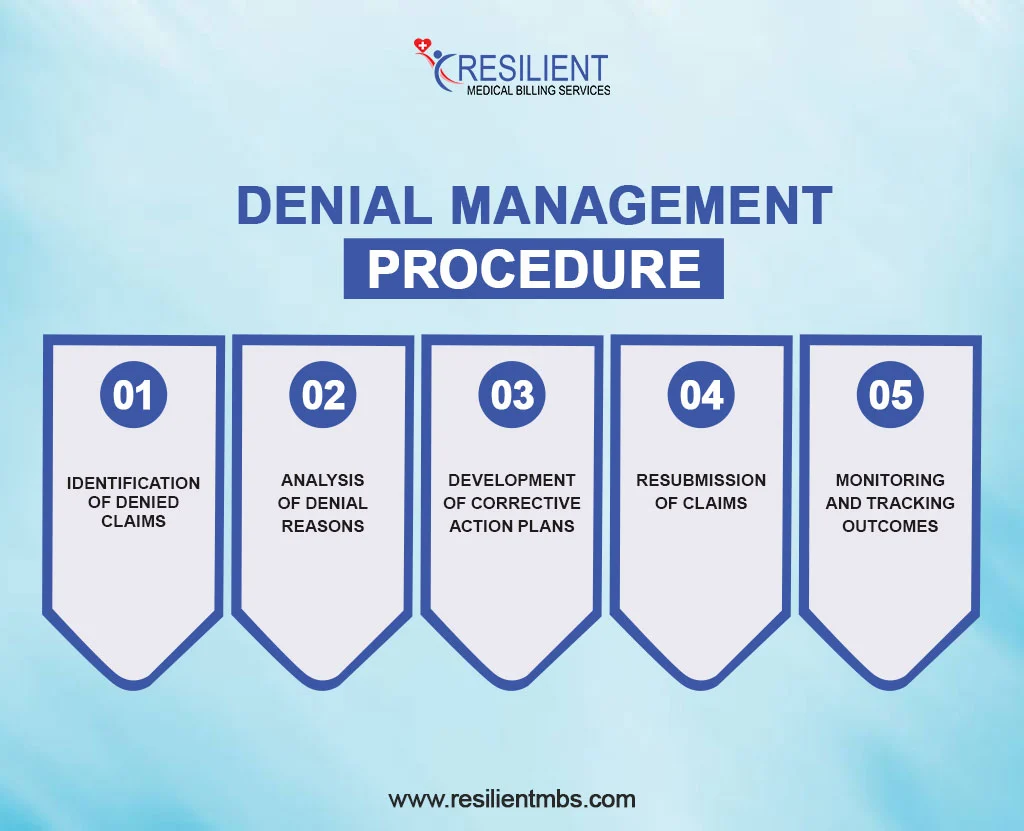

The Denial Management Process - A Step-by-Step Breakdown

Denial management assists those in the healthcare industry with financial health through handling of the denied claims. A structured denial management plan recognizes, addresses, and restores income.

The denial management procedure is explained step-by-step below:

1. Identification of Denied Claims

First, find insurance declined claims. EOB statements and denial reports are regularly monitored to achieve this. Practice management systems or revenue cycle management (RCM) software can streamline this process and catch all refused claims.

2. Analysis of Denial Reasons

After discovering the kinds of denied claims, it is very important to establish the causes of the denials. Some of the causes include wrong coding, inadequate documentation or failure to follow insurance requirements. These denials are then classified administrative, clinical, or technical and this makes it easier to evaluate them to allow an efficient handling of the problem.

3. Development of Corrective Action Plans

After identifying the main causes, remedial action plans should educate staff on claim submission procedures, update billing systems to prevent errors, and work with coders and providers to meet insurance standards. These measures combat current difficulties and prevent future denials.

4. Resubmission of Claims

Corrected claims are then resubmitted to the insurance company. This step requires meticulous attention to detail to ensure all issues are resolved. Timely resubmission is critical, as most payers have strict deadlines for reconsideration.

5. Monitoring and Tracking Outcomes

The final step is to track denial rates, recovery rates, and resolution times for resubmitted claims to evaluate the denial management process and identify areas for improvement.

Strategies for Effective Denial Management

- Before appointments, make sure your insurance covers them and that you are eligible.

- Get permission ahead of time for services that need it.

- Update a patient’s insurance details on a regular basis to avoid problems with old data.

- Keep up with the latest ICD-10, CPT, and HCPCS codes.

- Do a full audit of the claim before sending it in.

- Hire certified coding workers to improve accuracy.

- Teach people about the new codes and payer rules.

- Fewer mistakes caused by old ways of doing things.

- Help departments talk to each other so that submitting claims goes more smoothly.

- Keep an eye on rejection trends to find and fix problems that keep happening.

- Verifying eligibility and pre-authorization chores should be done automatically.

- Use data to make the billing process better before it happens.

- Deal with denials at all steps of the claim process.

- Make sure that providers’ operations run more smoothly and their finances are stable.

Benefits of a Proactive Denial Management Approach

Reduction in Revenue Leakage

Revenue leakage is significantly reduced with a strong denial management plan. Healthcare providers can recover lost funds by addressing claim denials at their source. The organisation maximises reimbursement and minimises financial losses.

Enhanced operational efficiency

Effective management of denials precedes the organization’s attempt to manage administrative issues or tasks to ensure the personnel handle claims before they go higher. Denial tracking and usage of automated work lists increase revenue cycle productivity. This cuts on the number of hours spent correcting claims and increases efficiency.

Better Outcome

A well-managed denial process speeds up claim resolution, reducing patient billing errors and improving patient financial communication. This boosts patient satisfaction and healthcare organization finances.

Final Thoughts!

Managing denials is the most critical component of the revenue cycle management program. A proactive approach implemented by healthcare providers can minimize all these issues to do with revenue loss, increase operation efficiency and increase patient satisfaction and organizational financial stability.

Nowadays, you can not afford to sit back and not regularly assess your techniques for this management. Effective denial management process does not only help to protect revenue but can also guarantee that your organization gives the patient a pleasant experience.

Ready to upgrade your denial management? Contact Resilient MBS for professional support and consultation services tailored to your unique needs. Our experts are committed to helping you optimize your revenue cycle and achieve financial success. Reach out today to learn more!