The shift from fee-for-service to value-based care is transforming how healthcare is delivered and how providers are compensated. The Merit-based Incentive Payment System (MIPS) is at the center of this change. It was designed by the Centers for Medicare & Medicaid Services (CMS) to reward high-quality, low-cost care.

As a healthcare provider, it’s essential to know how MIPS works and, even more so, how to avoid its penalties. Not meeting MIPS standards doesn’t simply damage your ratings. It can also lower your Medicare payments and put your practice’s financial viability in danger.

In this blog, we will explore:

- The fundamentals of MIPS and its components,

- Who is required to participate?

- The types and triggers of MIPS penalties,

- And how providers can prevent payment reductions through proper reporting and compliance.

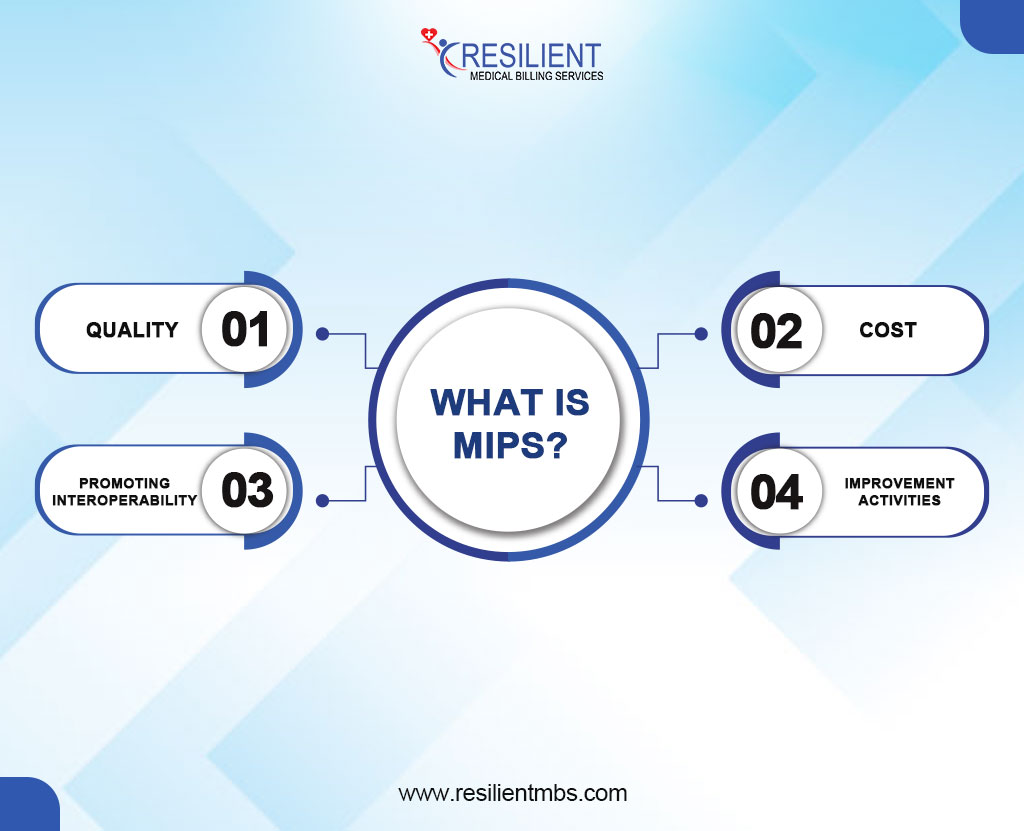

What Is MIPS?

MIPS meaning is a short for Merit-based Incentive Payment System, is a program that determines Medicare payment adjustments based on provider performance across four key categories:

- Quality – Measures healthcare outcomes and adherence to clinical best practices.

- Cost – Evaluates resource use and cost-effectiveness of care.

- Promoting Interoperability (PI) – Assesses the use of certified electronic health record (EHR) technology to improve information sharing.

- Improvement Activities – Encourages engagement in activities that enhance care processes and patient outcomes.

Each category is weighted and contributes to a provider’s final MIPS score, which in turn determines whether they receive a bonus, no adjustment, or a penalty.

Who is required to participate?

MIPS applies to eligible clinicians who bill more than a specified amount to Medicare Part B and see a minimum number of beneficiaries. This includes physicians, physician assistants, nurse practitioners, clinical nurse specialists, and certified registered nurse anesthetists, among others. CMS updates eligibility thresholds annually, so it’s important for providers to verify their status regularly.

Understanding MIPS Penalties

What is a MIPS penalty?

A MIPS penalty is a negative Medicare payment adjustment applied to clinicians who fail to meet the minimum MIPS performance thresholds. These penalties are designed to incentivize higher-quality care and better cost management.

MIPS penalties can include:

- Payment reductions of up to 9% based on poor performance or failure to report,

- Reimbursement delays due to audit issues or inaccurate data submissions,

- Loss of eligibility for positive adjustments or bonus payments.

The impact of these MIP penalties can include long-term financial strain, decreased practice efficiency, and reduced patient trust due to compromised care metrics.

Penalties are applied two years after the performance year—for example, poor MIPS performance in 2023 will affect Medicare payments in 2025.

Providers must pay close attention to CMS deadlines, performance benchmarks, and category weights to avoid penalties and improve their standing in future years.

Common Triggers for MIPS Penalties and How to Avoid Them

The Merit-Based Incentive Payment System (MIPS) plays a key role in Medicare’s shift to value-based care. While it offers opportunities for positive payment adjustments, it also carries the risk of penalties for underperformance.

Understanding the common triggers of MIPS penalties can help providers protect their reimbursement.

Incomplete or Late MIPS Reporting

Missing reporting deadlines or submitting incomplete data, often due to oversight or technical error, can lead to automatic penalties.

Low Performance in Any Category

MIPS scores are based on four categories: Quality, Cost, Promoting Interoperability, and Improvement Activities. Poor performance in any one area can lower the overall score and trigger a penalty.

Not Meeting Data Completeness Thresholds

CMS requires providers to report on at least 70% of eligible patients for Quality measures. Falling short results in zero points for that measure, significantly impacting the total score.

Not meeting the minimum performance level.

CMS sets a minimum score every year to keep people from getting in trouble. If you don’t fulfill it, even by a little bit, you could get unfavorable adjustments because of bad preparation or not enough data.

Strategies to Avoid MIPS Penalties

1. Timely, Accurate Reporting

Plan early and audit submissions to ensure compliance and avoid errors.

2. Prioritize High-Weighted Categories

Focus on Quality and Promoting Interoperability to boost your composite score.

3. Use EHR and Documentation Tools

Leverage technology to meet data completeness standards and reduce reporting burdens.

4. Monitor Benchmarks and Feedback

Analyze CMS reports and national benchmarks to identify areas for improvement and refine your strategy.

How MIPS Adjustments Work

MIPS payment adjustments are budget-neutral and directly linked to performance scores. Knowing how these adjustments are calculated helps providers manage both financial risks and opportunities.

How MIPS Adjustments Are Calculated

CMS uses a sliding scale based on a provider’s composite performance score:

- Negative Adjustment: Scores below the threshold result in penalties (up to -9%).

- Neutral Adjustment: Scores at the threshold lead to no payment change.

- Positive Adjustment: Scores above the threshold earn incentive payments, with bonuses for exceptional performance.

Adjustments apply two years after the performance year (e.g., 2025 data affects 2027 payments).

The Future of MIPS and Changing Penalty Structures

The Merit-based Incentive Payment System (MIPS) is making steady progress as the Centers for Medicare & Medicaid Services (CMS) focuses more on value-based care. Recent events show that there is a shift toward more advanced scoring models, a greater need for smooth interoperability, and a stricter review of quality performance.

These developments show that people expect providers to offer measurable, high-quality results while dealing with a more complicated performance context.

Trends in MIPS Scoring and CMS Policy Updates

CMS has raised MIPS performance thresholds, making it harder for providers to avoid penalties or earn bonuses. Key trends include:

- Higher Data Completeness Standards: More comprehensive data submission is now required, especially in Quality and Promoting Interoperability.

- Tighter Benchmarks: Updated national benchmarks demand stronger performance for above-average scores.

- Shifting Category Weights: Greater emphasis is being placed on the Cost category, with expected increases in its scoring weight.

- Focus on Equity and Interoperability: New measures highlight health disparities and digital health integration.

The Financial Impact of MIPS Penalties on Your Practice

Short-Term Revenue Loss

MIPS penalties can lead to a reduction of up to 9% in Medicare reimbursements, directly impacting a practice’s cash flow. These penalties are applied two years after the performance year, making timely compliance critical to maintaining stable revenue streams.

Long-Term Sustainability Challenges

Consistent underperformance in MIPS can result in compounded financial strain over time. Beyond immediate revenue loss, repeated penalties may affect your practice’s reputation, limit participation in value-based care programs, and hinder investment in quality improvement initiatives.

The Need for Proactive Compliance

Avoiding MIPS penalties is essential for financial stability. A strategic, year-round approach to MIPS reporting and performance improvement helps protect your practice’s income and positions it for long-term success in an increasingly value-driven healthcare landscape.

How Penalties May Change in Upcoming Performance Years

As the MIPS program continues to evolve, the Centers for Medicare & Medicaid Services (CMS) is expected to raise minimum performance thresholds each year, increasing the risk of penalties for underperformance.

The expanded use of administrative claims data may also lead to penalties based on passive data collection, limiting providers’ ability to correct inaccuracies.

Additionally, the introduction of new measures and subcategories will add complexity, requiring updated workflows, tools, and staff training. Providers who do not adapt to these changes risk facing significant MIPS penalties, including negative payment adjustments of up to -9% on future Medicare reimbursements.

Wrap-Up!

Avoiding MIPS penalties goes beyond meeting deadlines; it demands continuous performance monitoring, compliance with CMS thresholds, and adapting to policy updates. Common pitfalls, such as incomplete reporting, low scores, and data gaps, can lead to significant financial setbacks.

Don’t leave your Medicare reimbursements to chance. Partner with Resilient MBS for expert guidance, customized strategies, and full compliance support to boost your MIPS performance and safeguard your revenue.