Accurate documentation is the foundation of effective and compliant medical billing. It not only ensures timely and correct reimbursement but also promotes transparency in healthcare operations. One of the important aspects of EOR in medical billing is the Explanation of Review.

Typically issued by workers’ compensation and auto insurance carriers, the EOR explains how a claim was processed, detailing approved payments, denials, and any adjustments made. For healthcare providers and billing teams, understanding the EOR is essential to reducing claim denials and improving revenue cycle performance.

In this blog post, we’ll talk about what an EOR is, why it’s important, the different kinds of EORs, and how to understand them correctly to make your billing process go more smoothly.

Understanding the Basics of EOR

The Explanation of Review (EOR) is a document issued by insurance carriers, particularly in workers’ compensation and other third-party claims, that outlines how a medical claim was processed and reimbursed.

Unlike the Explanation of Benefits (EOB), which focuses on patient responsibility, the EOR is more technical and provider-focused, detailing payment decisions using specific codes and rationale.

While both EORs and EOBs explain claim outcomes, EORs emphasize payer adjudication based on fee schedules or medical necessity, rather than patient cost-sharing.

For billing teams and providers, understanding the EOR is vital. Misreading it can result in delayed payments or lost revenue. A clear grasp of its structure and terminology supports timely appeals, accurate adjustments, and overall billing efficiency.

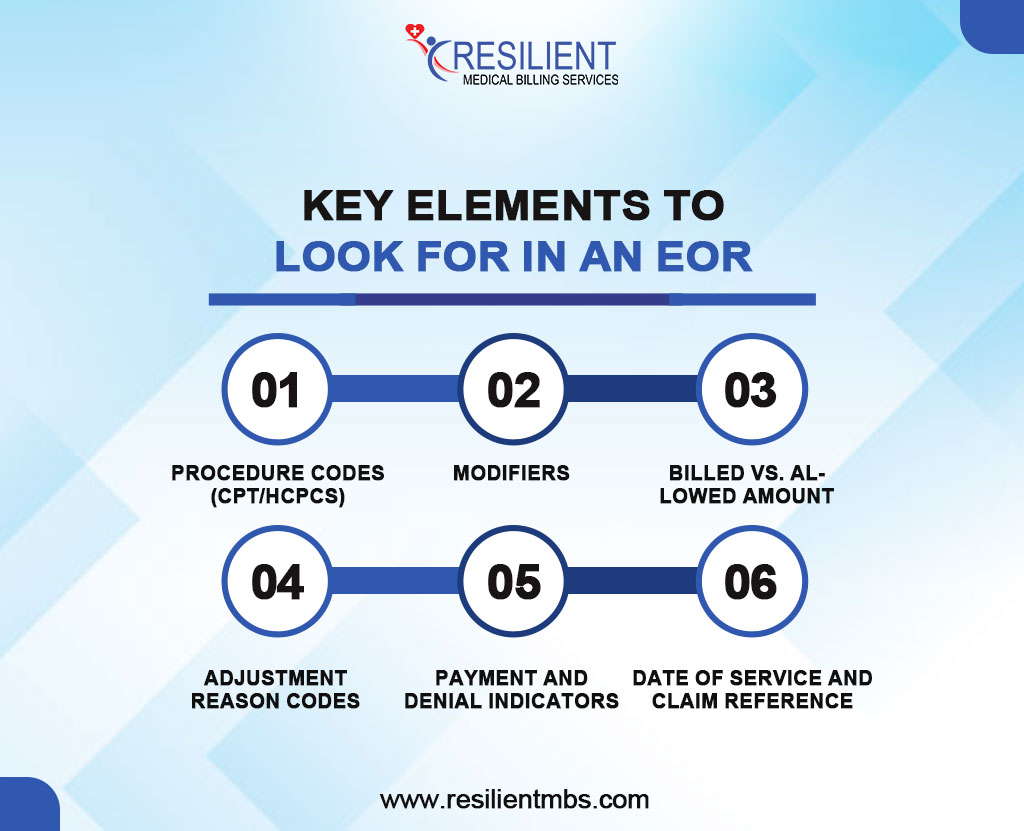

Key Elements to Look for in an EOR

An Explanation of Review (EOR) has important information that helps providers figure out how a claim was handled.

Careful examination of the following key elements ensures that reimbursement is correct and that the revenue cycle is managed well.

1. Procedure Codes (CPT/HCPCS)

These standardized codes represent the services provided. For example, CPT 99213 denotes an office or outpatient visit for an established patient. Providers should verify that the codes listed align with the services rendered.

2. Modifiers

Modifiers clarify the circumstances of the service, such as whether it was bilateral or part of a staged procedure. For instance, Modifier 59 indicates a distinct procedural service, and Modifier 25 is used when a significant, separately identifiable E/M service is provided on the same day.

3. Billed vs. Allowed Amount

The EOR typically lists both the provider’s billed charge and the insurer’s allowed amount. The difference often reflects contract adjustments, disallowed services, or bundling of procedures.

4. Adjustment Reason Codes

These alphanumeric codes explain why payment amounts differ from those billed. For example:

- CO-45: Charges exceed the fee schedule or maximum allowable amount.

- PR-1: Deductible amount.

Understanding these codes is critical for appealing denials or correcting claim errors.

5. Payment and Denial Indicators

The EOR shows whether a line item was paid, partially paid, or denied. Each item is linked to a reason code, guiding billing teams on next steps, such as appeal, resubmission, or write-off.

6. Date of Service and Claim Reference

Ensure the dates of service and claim numbers match the original submission to avoid confusion and track claim status accurately.

Explanation of Reimbursement Through EOR

The Explanation of Review (EOR) is a vital component of the medical billing cycle, offering a transparent summary of how a payer processes and reimburses a healthcare provider’s claim. It serves as a formal communication tool from insurance companies, including government programs like Medicaid, to providers, detailing the decisions made about submitted claims.

The EOR outlines how much of the billed amount will be reimbursed, along with specific reasons for any discrepancies or denials. Typically, it includes key elements such as:

- Billed Amount: The total amount charged by the provider for services rendered.

- Allowed Amount: The amount approved for reimbursement based on payer guidelines.

- Paid Amount: The actual payment issued to the provider.

- Denied Codes or Reason Codes: Explanations for partial or complete denial of the claim.

- Patient Responsibility: Any portion of the cost that must be paid by the patient (e.g., co-pay, deductible).

Billing departments need to know how the EOR works so they can find payment mistakes, fix underpayments, and start the appeals process as needed.

Also, the reimbursement information in an EOR is strongly related to rules imposed by the government, including the Medicaid Fee Schedule 2025, and rules set by private insurance companies. These rules say which services are covered and how much they cost, so it’s very important for providers to stay up to speed with the annual adjustments.

EORs help you see if reimbursements are in line with these standards, which helps make sure that the fund is correct and that the rules are followed.

Types of EORs and Their Importance

EORs vary based on the stage of the claims review process, each serving a distinct purpose in facilitating clear communication between payers and providers:

Initial Claim Review EORs – Issued after the first claim review, detailing reimbursement decisions, denials, or adjustments.

Appeal Response EORs – Provided when a denied claim is challenged, indicating whether the decision is upheld or reversed.

Corrected Claim EORs – Generated after a revised claim with updated information is submitted.

Reconsideration EORs – Issued following a secondary review requested by the provider, outside of the formal appeal process.

Beyond reimbursement guidance, EORs are essential in audits and appeals, serving as official records that support a provider’s case during internal reviews or legal proceedings. Proper interpretation can mean the difference between recovered revenue and lost income.

Understanding EOR types helps providers and billing teams improve claim accuracy, optimize revenue cycle management, and secure timely payments.

Electronic vs. Paper-based EORs

The Explanation of Review (EOR) can be delivered in electronic or paper format, both serving to communicate an insurer’s claim decision. However, they differ in speed, accessibility, and efficiency.

Electronic EORs (e-EORs) are transmitted securely through clearinghouses or payer portals, offering real-time access and reducing administrative delays. In contrast, paper-based EORs are mailed and require manual processing, increasing the risk of delays and errors.

Benefits of e-EORs include faster turnaround, improved accuracy through automation, and seamless integration with billing systems for quicker reconciliation and appeals.

Security-wise, e-EORs offer encryption and audit trails that meet HIPAA standards, while paper EORs are more vulnerable to loss and unauthorized access.

Significance of EOR in Medical Billing

MIPS-Penalties-Explained-Triggers-and-How-to-Avoid-Them

EORs help identify underpayments, denials, and processing errors, enabling billing professionals to take corrective actions such as appeals or claim resubmissions.

They also support revenue cycle optimization by revealing payer trends, denial patterns, and reimbursement behaviors, allowing providers to refine billing strategies and improve financial outcomes.

Additionally, EORs enhance communication between payers and providers by clearly explaining payment decisions, reducing disputes, and fostering accountability.

Common Challenges and Best Practices

While essential to the billing process, EORs can pose challenges such as missing details, inconsistent formatting, vague denial codes, and non-standard terminology, leading to delays and confusion.

To effectively manage these issues, adopt the following best practices:

- Verify all adjustment codes and reasons listed in the EOR.

- Cross-reference EOR data with the original claim and patient records.

- Initiate appeals promptly when discrepancies or denials occur.

- Document every response for compliance and audit readiness.

Using contemporary revenue cycle management (RCM) solutions can greatly improve EOR processing. These systems automate claim matching, highlight errors, and send follow-up alerts. This cuts down on manual work and makes billing more accurate.

Wrap-Up!

Understanding and using EORs effectively is key to successful medical billing. Whether electronic or paper-based, they provide essential insights for compliance, reimbursement, and financial decisions.

Recognizing their role in identifying underpayments and improving revenue cycles helps providers boost transparency, efficiency, and financial stability.

To make sure your company is correctly analyzing and handling EORs, work with specialists who know the ins and outs of the reimbursement scene. Call Resilient MBS LLC today for personalized medical billing help and EOR management solutions that get matters done.