Conducting a medical billing audit is a smart move for healthcare providers looking to maintain compliance and strengthen their financial performance. These evaluations help pinpoint billing issues, reduce claim denials, and highlight areas for improvement. By refining their billing practices, providers can accelerate reimbursements and deliver care more effectively.

In this blog, we are going to discuss the importance of medical billing audits, how they help identify billing discrepancies and the role they play in ensuring compliance with healthcare regulations.

We’ll also discuss how medical bill audits affect healthcare providers’ revenue and why Florida’s competitive and regulated market requires a dependable billing audit company.

What is a Medical Billing Audit?

A medical billing audit is a comprehensive review of clinical documentation, coding, and billing records to ensure accuracy, completeness, and compliance with payer policies and federal regulations like those from CMS.

There are two main types:

- Internal audits – Conducted by the provider’s team for routine, preventive checks.

- External audits – Carried out by third-party services for objective validation or preparation for external reviews.

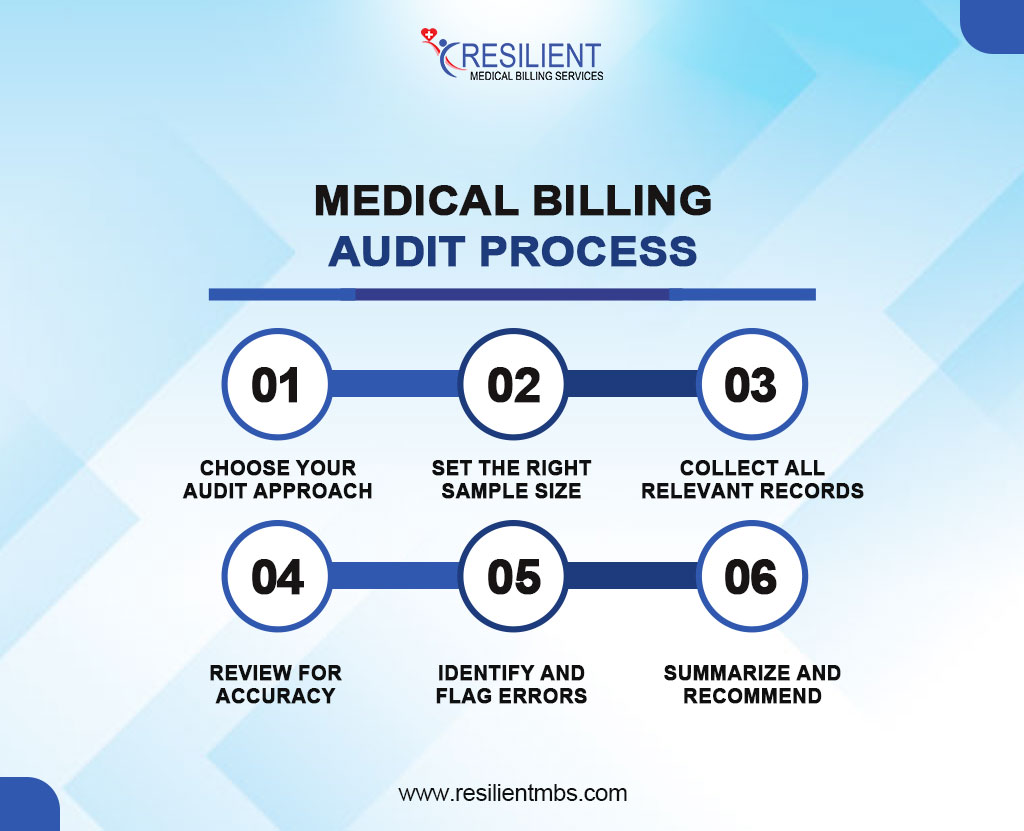

Medical Billing Audit Process

A medical billing audit involves six key steps to ensure accuracy and compliance:

- Choose Your Audit Approach

Decide whether to conduct a random, focused, or blended audit. Random reviews select claims based on value, focused audits dive deep into specific claims, and blended audits combine both methods. Ensure you have the right team and tools before starting.

- Set the Right Sample Size

Pick a sample that reflects different types of patient visits. A typical audit uses 10–15 charts per provider. Tools like RAT-STATS help ensure statistically sound results and align with payer expectations.

- Collect All Relevant Records

Gather all supporting documents for each selected claim. This includes charts, superbills, EOBs, claim forms, and related notes or test results. Understanding your record structure is key to a smooth review.

- Review for Accuracy

Evaluate both coding and documentation using official coding guidelines. Pay attention to new vs. established patients, referrals vs. consults, time-based services, and non-physician billing rules.

- Identify and Flag Errors

Look for common mistakes like incorrect procedure or diagnosis codes, missing modifiers, unsupported E/M levels, or unbilled services. Document patterns and risk areas.

- Summarize and Recommend

Compile a clear report outlining your process, findings, and recommendations. Highlight error trends and suggest solutions like additional training or documentation changes. Include plans for follow-up audits to track progress.

Benefits of Outsourcing to a Medical Billing Audit Company

- Cost savings and increased accuracy by partnering with experienced medical billing audit companies

- Reduced claim denials and faster reimbursements through expert medical billing audit services that identify and correct coding and compliance errors

- Improved revenue cycle performance by uncovering inefficiencies and ensuring accurate billing practices

- Enhanced compliance with healthcare regulations through ongoing monitoring by professional medical billing audit companies

- More time to focus on patient care while qualified experts manage complex billing and audit processes efficiently

Why Florida Healthcare Providers Need Billing Audits

Florida’s healthcare system has its problems that make regular checks of medical bills not only helpful but necessary. Florida has one of the highest percentages of Medicare recipients in the country. As a result, providers there have to deal with a complicated reimbursement system that is heavily controlled and often changes.

This Medicare-heavy setting makes it more likely that claims will be denied and payments will be delayed, which can have a big effect on healthcare facilities’ cash flow.

There are also a lot more managed care plans and value-based payment models in Florida, which makes medical billing even more complicated. Coding mistakes, not keeping enough records, or not following the rules set by each payer can cause expensive mistakes and even checks by government agencies. Because of these risks, healthcare offices need to make sure their billing processes are correct, follow the rules, and work as well as they can.

These risks can be cut down a lot by working with a medical billing audit company that knows how the rules work in Florida. Local auditors know the rules that payers must follow in each state, the ins and outs of Medicaid, and the regional trends that affect the acceptance of claims. Their insights help providers fix weaknesses before they happen and make the revenue cycle run more smoothly.

Choosing the Right Audit Partner

A reliable medical billing audit company makes things run more smoothly and in line with the rules.

- Tech-Driven Accuracy

Top firms use AI and advanced software to identify billing errors and denial patterns, enhancing accuracy and minimizing manual mistakes.

- Clear Reporting

Effective audits provide transparent reports with discrepancies, root causes, and corrective actions to drive improvement.

- Compliance Assurance

Trusted firms strictly follow HIPAA and payer policies, protecting patient data and reducing legal risks.

Choosing the top medical billing audit company in Florida is a strategic decision that can boost a practice’s efficiency. A thorough audit finds coding problems, income leakage, and documentation integrity.

Accurate data and tailored recommendations help clinics improve procedures, optimize reimbursements, and prioritize patient care over administrative tasks.

Healthcare providers can work with a billing audit business that improves operational performance and long-term success by prioritizing local expertise, proven results, certified personnel, and strategic outcomes

Struggling with Revenue Gaps? Resilient MBS Can Help

Revenue leaks and compliance risks can hold your practice back. Resilient MBS provides targeted billing audit solutions to fix errors, close compliance gaps, and improve profitability with confidence.

We’ve helped providers across specialties increase collections and stay compliant. Beyond audits, we offer:

- Medical Billing

- AR Management

- Claims Processing

- Coding

- Credentialing

Concluding Thoughts!

As healthcare gets more complicated, picking the right medical billing auditing company isn’t just a smart business move; it’s a strategic move to protect income, ensure compliance, and boost operating efficiency.

To keep from losing finances, a detailed audit might find ways to increase billing, fix coding issues, and find lost income.

The local experience, regulatory understanding, and responsive support of Florida medical billing audit businesses helps healthcare providers. Faster return times, increased communication, and a more tailored audit are often results from this proximity.

Contact Resilient MBS LLC right away to enhance your finances and revenue cycle. Our experienced auditors help companies just like yours to have accurate billing, quicker reimbursements, and continued growth.