Claim denials are one of the largest threats to healthy cash flow in healthcare. A denial occurs when an insurer refuses to pay all or part of a submitted claim, for reasons ranging from incorrect patient data to medical necessity disputes.

Moreover, Denial codes and reasons in medical billing are standardized payer messages (CARCs and RARCs) that explain why a claim was adjusted or rejected and point billing teams to the corrective action.

This article reviews the most frequent denial codes and reasons in medical billing, explains what each code means, and gives step-by-step fixes you can apply to recover revenue faster and prevent repeat denials.

Understanding common denial codes in medical billing helps healthcare providers identify issues quickly, reduce claim rework, and protect cash flow.

Understanding Denial Codes and Their Role in Revenue Cycle Management

Denial codes and reasons in medical billing are central to an efficient revenue cycle. CARCs (Claim Adjustment Reason Codes) tell you the high-level reason a payment was adjusted; RARCs (Remittance Advice Remark Codes) provide supplemental detail or instructions.

However, when denial codes are triaged and analyzed, they create a feedback loop for front-end registration, coding, clinical documentation, and appeals, reducing AR days and improving first-pass acceptance.

Moreover, A sound RCM (revenue cycle management) strategy treats denial codes as diagnostic signals: track frequency, quantify lost dollars per code, assign ownership, and close the loop with process changes.

Types of Denial Codes

- CARC (Claim Adjustment Reason Codes): High-level payer reasons such as “patient responsibility,” “coordination of benefits,” or “not covered.” Example: CO 22 (coordination of benefits).

- RARC (Remittance Advice Remark Codes): Clarifying notes used with CARCs to explain payer rules, documentation needs, or appeal instructions.

- EDIs / Payer-Specific Codes: Some payers append proprietary codes or require adjudication notes; include them in your denial taxonomy.

Action: map incoming EOB/ERA codes to internal denial buckets (eligibility, coding, medical necessity, timely filing, patient responsibility) so you can report trends and assign corrective work.

Types of Denials

- Complex Denials: Final decisions where payment won’t be made, and the claim can’t be corrected or appealed.

- Soft Denials: Temporary issues that can often be fixed by correcting errors or sending additional information.

By tracking and studying denial codes, billing teams can spot common problems like incorrect codes, missing documents, or authorization issues.

Fixing these patterns helps reduce future denials, speed up payments, and strengthen the overall revenue process.

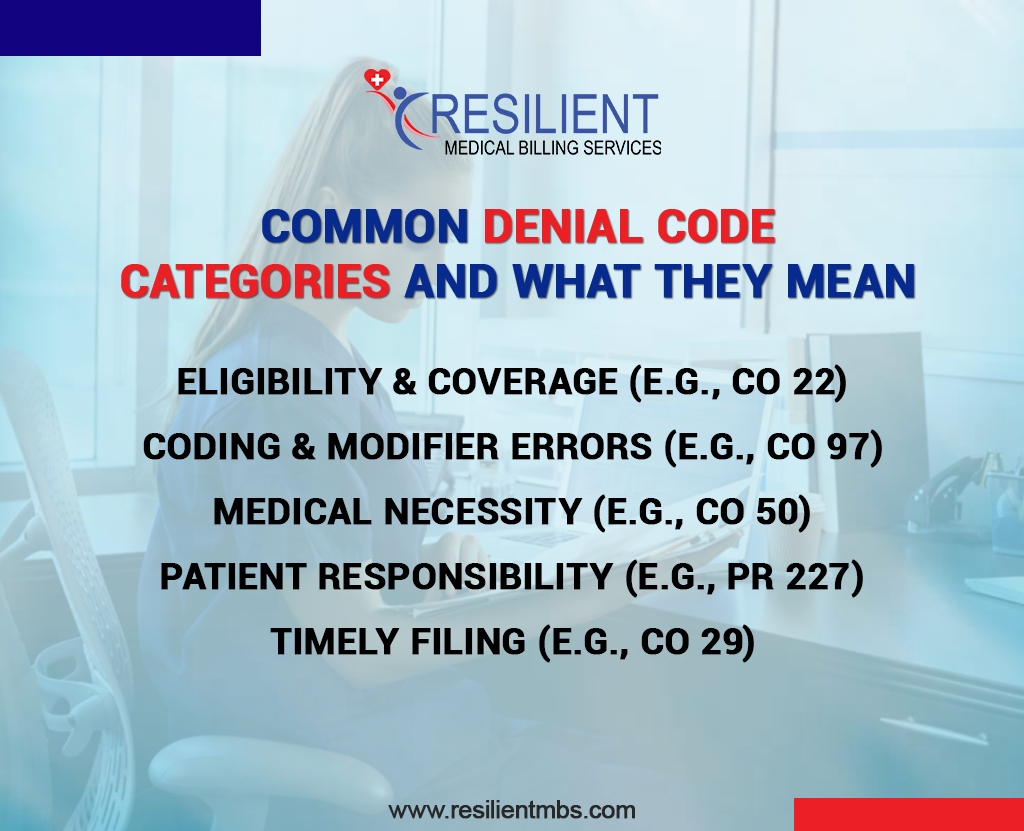

Common Denial Code Categories and What They Mean

Understanding the common denial codes and reasons in medical billing helps teams quickly identify the root cause. The primary categories are:

- Eligibility & Coverage (e.g., CO 22) — problems with primary/secondary payer hierarchy or inactive coverage.

- Coding & Modifier Errors (e.g., CO 97) — unbundling, wrong CPT/HCPCS, or improper modifier use.

- Medical Necessity (e.g., CO 50) — services not supported by documentation or payer criteria.

- Patient Responsibility (e.g., PR 227) — other payer exists or patient owes the balance.

- Timely Filing (e.g., CO 29) — claim was submitted after the payer deadline.

For each category, document a one-line remediation path and SLA (e.g., eligibility denials → 48-hour front-office verification; coding denials → coder review within 72 hours).

1. Eligibility and Coverage Denials (CO 22)

Meaning

CO 22 indicates a coordination-of-benefits issue, the claim was billed to the wrong payer, or the secondary payer was not billed after a primary denial.

Common reasons

Outdated patient insurance on file, multiple active coverages, and incorrect primary/secondary hierarchy.

How to Fix It

- Immediately verify patient demographics and insurance at the point of care (best practice: verify at check-in and again at charge capture).

- Confirm primary vs. secondary payer using the payer’s COB rules (id cards, employer benefits).

- If the primary payer denied, send the corrected claim to the correct payer with ERA/EOB attached and update the patient file.

- Track CO 22 occurrences in a denial dashboard and set a KPI (e.g., reduce CO 22 denials by 30% in 90 days).

2. Coding and Modifier Errors (CO 97)

Meaning

CO 97 signals that the billed service was considered included in another service, or the modifier was applied incorrectly. This commonly shows up when unbundling rules or NCCI edits are violated.

Common Reasons

Incorrect CPT selection, missing or improper modifiers (59/25/XS/XE), duplicate submissions, or unclear documentation.

How to Fix It

- Pull the EOB and payer-edit details; identify whether it’s an NCCI pair or payer-specific bundling.

- Review clinical documentation to confirm if the service was truly distinct, document rationale (separate site, separate session, different diagnosis).

- Apply the appropriate modifier only if documentation supports it (consider CMS X-modifiers as specific alternatives to 59 where applicable).

- Resubmit with corrected codes/modifiers and attach supporting documentation. Add this code type to coder training and create pre-bill scrub rules that flag likely CO 97 scenarios.

3. Medical Necessity Denials (e.g., CO 50 – Not Medically Necessary)

Meaning

Payer determined the service lacks medical necessity based on the submitted documentation or clinical criteria.

Common Reasons

Missing prior authorization, insufficient diagnostic evidence, and billing for routine services lacking therapy justification.

How to Fix It

- Match the denial to payer medical necessity guidelines, and identify missing clinical elements.

- Obtain and attach medical records, progress notes, imaging/lab results, and the treating provider’s rationale.

- If appropriate, secure retroactive prior authorization (where the payer allows) or file a clinical appeal with peer-reviewed evidence.

- Prevent future CO 50 denials by adding medical necessity checklists to clinician templates and flagging high-risk services pre-bill.

4. Patient Responsibility Denials (PR 227)

Meaning

PR 227 indicates that another payer should be billed first, or the patient’s coverage hierarchy is incorrect.

Common Reasons

New insurance not updated, incomplete coordination of benefits, or incorrectly recorded secondary payer.

How to Fix It

- Re-verify the patient’s insurance details and obtain front-office confirmation of primary insurance.

- If another payer is primary, correct the payer sequence and resubmit with EOB attachments.

- Communicate with the patient if coverage has changed and collect any outstanding co-pays once the primary payer has adjudicated.

- Log PR 227 incidents and retrain registration staff on payer verification SOPs.

5. Timely Filing Denials (CO 29)

Meaning

CO 29 indicates the claim missed the payer’s submission timeframe.

Common Reasons

There is a backlog in claim submission, delays in documentation, or misrouted claims.

How to Fix It

- Immediately confirm the payer’s timely-filing window (90/180/365 days, depending on the payer).

- If there’s a valid reason (e.g., hospital data lag), file a timely-filing appeal with proof of cause and supporting documentation.

- Implement a claim-tracking system to flag aging unsigned/unsent claims and set an SLA for submission (e.g., submit within 7 days of discharge).

- Monitor CO 29 frequency and reduce occurrences by adjusting workflow or adding automation where needed.

List of Common Denial Codes in Medical Billing (Quick Reference Table)

Below are high-value codes to track as part of your denial management program. For each code, assign an owner and a next-step remediation SLA.

| Denial Code | Description | Common Reason | How to Address |

| CO 22 | Coordination of Benefits | Multiple insurance plans | Verify primary/secondary coverage |

| CO 50 | Not medically necessary | Missing documentation or prior authorization | Review medical necessity, submit appeal |

| CO 97 | Service included in another procedure | Unbundled or duplicate CPT codes | Use the correct modifier or review NCCI edits |

| PR 227 | Patient has other payer coverage | COB or patient insurance update needed | Verify insurance hierarchy |

| CO 29 | Claim filed after the deadline | Missed payer filing window | Track submission timelines |

Root Causes Behind Frequent Denials

Most denials trace back to preventable process failures. Common root causes include: incomplete front-end insurance capture, weak documentation workflows, misapplied CPT/modifier logic, and poor claim-tracking discipline.

Moreover, perform a weekly denial root-cause analysis: categorize by code, calculate lost dollars per code, and identify the top 3 process gaps causing repeat denials. Then run focused PDSA cycles (Plan-Do-Study-Act) to eliminate the highest-impact errors.

Incomplete or Incorrect Patient Information

Simple errors like a wrong date of birth, policy number, or insurance details can cause eligibility issues and claim denials. Always double-check patient information at every visit to avoid these problems.

Missing or Outdated Authorizations:

Some services need prior authorization from the insurance company. If the approval is missing or expired, the claim will be denied. Keeping a record of all authorizations helps ensure they’re current and valid.

Incorrect Coding or Modifier Use

Using the wrong codes or forgetting required modifiers is a common reason for denials. Regular coding checks can make sure claims follow payer rules and reduce errors.

Not Enough Documentation

Insurance payers need proof that a service was medically necessary. If the provider’s notes are missing or unclear, the claim may be denied. Clear and complete documentation supports the claim and speeds up approval.

Delays in Claim Submission

Submitting claims late or not fixing denied claims quickly can lead to lost payments. Setting reminders and following timelines helps keep the process smooth.

Understanding these common causes is the first step toward preventing denials and improving claim success.

How to Address and Prevent Denials Effectively

Reducing claim denials requires a proactive strategy built on accuracy, technology, and team training.

- Front-End Accuracy:

Verify insurance and pre-auth eligibility at check-in and pre-procedure. (KPI: 95% front-end verification rate)

- Automated Claim Scrubbing:

Use automated NCCI, modifier, and revenue-code scrubs before submission. (KPI: >90% first-pass acceptance)

- Denial Triage Workflow:

Route denials to specialized teams, eligibility, coding, and clinical appeals within 24–48 hours.

- Denial Analytics:

Weekly dashboards listing the top 10 denial codes, dollars lost, and rework hours.

- Appeal Templates:

Standardize clinical appeal bundles (summary, chart note extracts, guidelines).

- Ongoing training:

Monthly coder and front-office refreshers on top denial drivers.

- SLA and Ownership:

Assign owners for each denial category and a 14-day closure SLA for appeals or resubmissions.

Implement these playbook items and measure improvement: target a 25–40% reduction in denial rates within the first 90 days.

The Role of Billing Teams in Denial Management

Successful denial management requires a clear RACI (Responsible, Accountable, Consulted, Informed) for denial buckets: registration owns eligibility, coders own coding-related denials, the clinical team provides documentation for medical necessity appeals, and the AR/denials team manages payer follow-up.

Moreover, run a weekly denial review meeting (30–45 mins) to review top codes, assign action items, and track appeal outcomes. Use cross-functional scorecards to keep leadership informed on denial-to-recovery ratios.

Benefits of Understanding Denial Codes and Reasons

Understanding denial codes improves every aspect of the revenue cycle:

Faster Claim Resolution: Identifying denial causes allows for quick corrections and resubmissions, reducing AR days.

Improved Compliance: Accurate coding and documentation lower audit risks.

Better Revenue Forecasting: Tracking denial trends supports informed financial planning.

Higher Staff Efficiency: Recognizing common denial patterns reduces rework and errors.

When to Consider Outsourcing Denial Management

Outsource when internal denial rates or aged AR exceed sustainable thresholds. Typical benchmarks that justify outsourcing: denial rate > 10–12% of total claims, days-in-AR > 60, or unresolved appeals > 30% of AR dollars.

Moreover, A vendor specializing in denial management should provide analytics, a proven appeals process, and an ROI model showing recovered dollars vs. fees. Resilient MBS can provide analytics-driven denial recovery, tailored appeals, and workflow redesign to recover revenue and reduce future denials.

If claim denials are impacting your revenue cycle, contact Resilient MBS for expert denial management solutions customized for hospitals and clinics.

Wrap-Up

Understanding denial codes and reasons in medical billing is essential to maintaining a healthy revenue cycle. Every code, from CO 22 (coordination of benefits) to CO 50 (not medically necessary), CO 29 (timely filing), and PR 227 (other payer), tells you what to fix. Use a data-driven denial program: categorize denials, assign owners, apply SLAs, and measure recovery dollars and first-pass acceptance.

Prioritize these operational steps: strengthen front-end eligibility checks, add automated pre-bill scrubs, run weekly root-cause reviews, and standardize appeal bundles. Over time, this reduces AR days, lowers denials, and improves cash flow.

FAQs

What are denial codes in medical billing, and why do they matter?

Denial codes are standardized payer messages (CARCs/RARCs) that explain why a claim was rejected or adjusted. They matter because they point billing teams to the exact fix needed, eligibility, coding, medical necessity, or timely filing.

What does CO 22 mean, and how do I fix it?

CO 22 indicates a coordination-of-benefits issue; the wrong payer was billed first. Fix it by verifying primary vs. secondary coverage, updating patient insurance details, and resubmitting to the correct payer with ERA/EOB documentation.

What should I do if a claim is denied for medical necessity (CO 50)?

Gather the treating provider’s clinical notes, diagnostic evidence (labs/images), and payer medical policy. Submit a clinical appeal with a succinct cover letter linking documentation to the payer’s criteria.

How can we prevent coding/modifier denials like CO 97?

Use NCCI rules, apply the correct CPT/HCPCS and modifiers (or CMS “X” modifiers when appropriate), and include clear documentation showing why services were distinct. Add automated pre-bill edits for high-risk code pairs.

What does PR 227 mean, and how do I resolve it?

PR 227 means the patient likely has another payer. Confirm updated insurance information, correct the payer order, and resubmit to the primary insurer with supporting EOBs.