Medical billing connects patient care to payment, but the fundamental difference between hospital and physician billing is crucial to ensuring claims are paid correctly. Hospital and physician billing represent two distinct revenue streams: institutional billing (facility costs such as rooms, labs, imaging, and supplies) and professional billing (the clinician’s evaluation, procedures, and interpretation). When teams understand hospital billing vs professional billing, they reduce duplicate charges, prevent denials, and keep cash flow steady.

This article explains the practical distinctions between professional vs institutional claims, how coding and forms differ (UB-04 vs CMS-1500), and the operational steps billing teams should take to avoid common errors. Whether you manage a hospital revenue cycle or run a clinic, learning these differences helps you stay compliant, reduce appeals, and improve your organization’s financial health.

The Basics of Medical Billing in Healthcare

Medical billing turns clinical encounters into claims that payers can adjudicate. When we discuss the difference between hospital and physician billing, we’re comparing two complementary revenue streams: institutional (hospital) billing for facility resources and professional (physician) billing for provider services.

The billing cycle always begins with patient registration and insurance verification. Still, the downstream workflows diverge: hospitals assemble institutional claims that reflect facility charges (room/board, supplies, imaging, use of operating rooms), while physicians submit professional claims for the clinician’s time and expertise (office visits, procedure work, radiology reads). Accurate documentation, correct coding, and clear ownership of each charge are essential to prevent duplication, payer denials, and delayed reimbursements.

Key operational points to note: timely eligibility checks, consistent charge capture across hospital departments, and disciplined provider documentation. These basics are the foundation that prevents errors when managing hospital and physician billing concurrently.

What Is Hospital Billing (Institutional Billing)?

Hospital billing, or institutional billing, packages the hospital’s role in care delivery into a claim that captures facility resources and episodic costs. Institutional claims commonly use the UB-04 (CMS-1450) form and rely on coding systems that include revenue codes, ICD-10 procedure codes, and DRG (Diagnosis-Related Group) groupings for inpatient services.

Institutional billing typically aggregates charges from multiple departments (radiology, lab, pharmacy, nursing, imaging, OR) into one claim for the episode of care. Hospitals may be reimbursed under bundled payments, per-diem rates, or DRG-based arrangements, depending on payer contracts. Common pitfalls include misapplied revenue codes, missing itemized charges from ancillary departments, and failure to include necessary pre-auths for high-cost services.

When explaining hospital billing vs professional billing, emphasize that the hospital is billing for the place and the resources, not the clinician’s professional decision-making.

What Is Physician Billing (Professional Billing)?

Physician billing, also known as professional billing, captures the clinician’s services, knowledge, and skilled work. These claims are submitted on the CMS-1500 form (or electronically as 837P) and use CPT and HCPCS codes to describe evaluation and management (E/M) services, procedures, and professional interpretations.

However, unlike institutional claims, provider claims price the clinical encounter itself, the assessment, decision-making, and hands-on methods.

Coding Systems in Hospital and Physician Billing

Both hospital and physician billing rely on structured code sets, but each uses them differently:

- Physician / Professional Billing: Primarily CPT (procedure codes) and HCPCS Level II (supplies, durable medical equipment), plus ICD-10 diagnosis codes to justify medical necessity. E/M guidelines and appropriate CPT selection are critical to professional reimbursement.

- Hospital / Institutional Billing: Uses revenue codes, ICD-10 procedure codes, UB-04-specific fields, and DRGs for inpatient groupings. Institutional claims often require accurate charge master entries and correct mapping of departmental charges to revenue center codes.

Understanding these differences (CPT focus vs revenue/DRG focus) is central to addressing the difference between hospital and physician billing and preventing double-billing or inappropriate bundling across claim types.

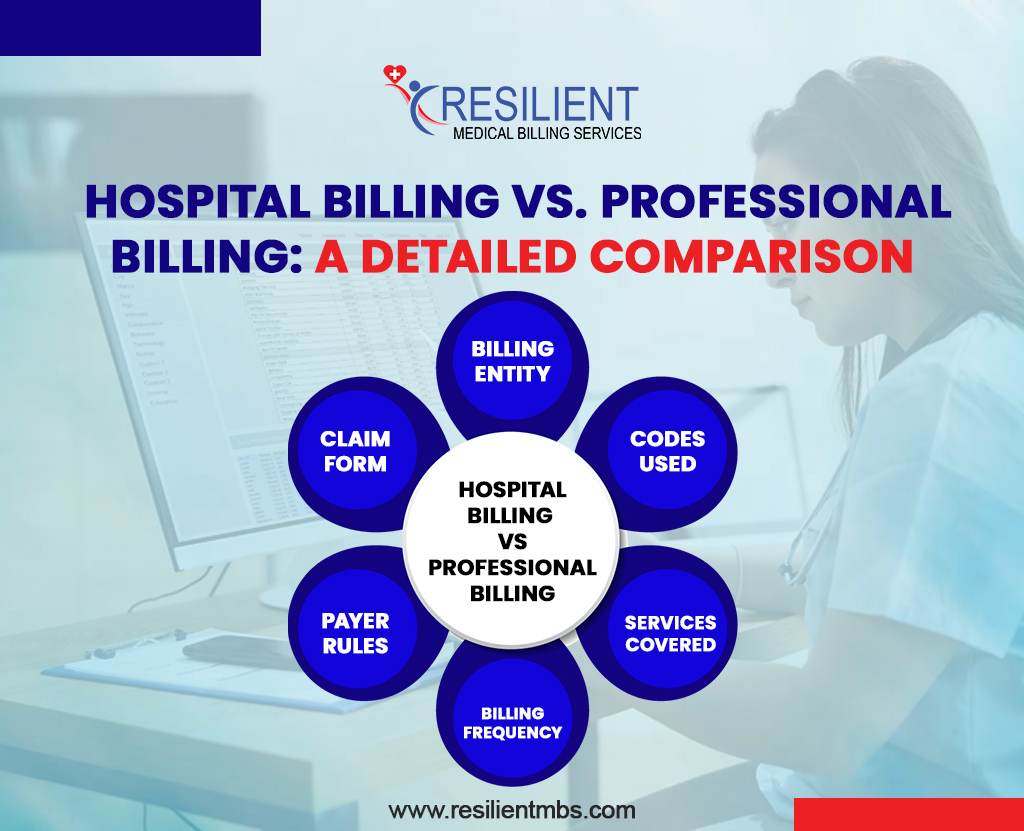

Hospital Billing vs. Professional Billing: A Detailed Comparison

The hospital billing vs professional billing table summarizes the practical distinctions that matter most to revenue operations. Use the table for quick training, but back it with policy; e.g., confirm payer-specific bundling rules and whether a given service is considered an Institutional or Professional charge. Regularly update the table with payer exceptions and local contract terms to reduce denials.

| Aspect | Hospital Billing (Institutional) | Physician Billing (Professional) |

| Claim Form | UB-04 (CMS-1450) | CMS-1500 |

| Billing Entity | Hospitals and healthcare facilities | Individual practitioners and clinics |

| Codes Used | ICD-10, HCPCS, Revenue Codes, DRGs | ICD-10, CPT, HCPCS |

| Services Covered | Facility fees, room and board, supplies, and nursing care | Provider services like consultations, procedures, and follow-ups |

| Billing Frequency | Often for the entire hospital stay or episode of care | Per visit or procedure |

| Payer Rules | Based on institutional contracts and bundled payments | Based on provider contracts and fee-for-service models |

Professional vs. Institutional Claims – Understanding the Difference

Professional vs institutional claims serve different purposes and are adjudicated under different rules. Professional claims focus on clinician services and typically follow a fee-for-service logic, while institutional claims reflect facility use, supplies, and occupancy.

A frequent operational error is submitting facility charges on a CMS-1500 or billing physician services on a UB-04, both of which can lead to denials and appeals. Design clear handoffs in your clinical workflow so that charge capture and billing information are recorded at the time of service.

| Aspect | Professional Claims | Institutional Claims |

| Submitted By | Individual providers (e.g., physicians, outpatient clinics) | Hospitals and healthcare facilities |

| Purpose | To bill for specific professional services performed by a provider | To bill for facility-based services, such as inpatient or outpatient care |

| Claim Form | CMS-1500 | UB-04 (CMS-1450) |

| Coding Used | CPT and HCPCS Level II codes | Revenue codes and ICD-10 procedure codes |

| Examples of Services | Office visits, consultations, telehealth, diagnostic interpretations | Room charges, nursing care, lab services, equipment use |

| Common Errors | Submitting facility services on a professional claim | Duplicating or mixing professional and institutional charges |

| Impact of Errors | Claim denials and delayed reimbursement | Claim denials and delayed reimbursement |

The Role of Billing Teams in Coordinating Hospital and Physician Claims

Accurate billing depends on cross-team coordination. Hospital and physician billing teams must align on charge ownership, documentation needs, and timing of submission. Recommended practices:

- Create a standardized charge capture checklist for common episodes (surgery, observation, ED visit) that lists facility charges vs provider services.

- Use shared access to the EHR or charge reconciliation file so billing teams can see which charges were applied by which department.

- Establish escalation paths for ambiguous items (e.g., a device used in surgery where it’s unclear whether the hospital or the physician bills).

- Conduct regular coding huddles, held weekly or biweekly, to review denied claims and address recurring process breakdowns.

Good coordination reduces duplicate billing, speeds up claims processing, and lowers the number of days in accounts receivable (AR).

If you want to simplify hospital and physician billing, contact Resilient MBS for specialized medical billing services designed for hospitals and clinics.

How the Difference Impacts Reimbursement and Revenue Cycle

The difference between hospital and physician billing directly affects cash flow, denial rates, and audit exposure. Institutional claims are often larger and may be subject to DRG bundling rules or global contracts, while professional claims are typically smaller per claim but more numerous. Key impacts:

- Payer Edits and Bundling: Misclassification can trigger NCCI edits or payer denials (e.g., charging a facility fee when the payer considers it bundled with the physician service).

- AR and Appeals Load: Professional claims often require more frequent denials/appeals handling per encounter; institutional claims tend to involve complex clinical documentation and retrospective medical necessity reviews.

- Contracting Considerations: Provider contracts and hospital contracts may utilize different fee schedules; therefore, reconciling expected payments across both streams is essential for accurate forecasting.

- Action step: Run split-revenue reporting (facility vs. professional) monthly to identify trends and payer variances early.

Why Accurate Billing Matters

Accurate professional vs institutional claim submission keeps reimbursements timely and legally sound. Incorrect submissions can result in recoupments, audits, or contractual penalties. Good documentation, correct claim form use, and managerial oversight keep revenue predictable and defensible.

The Value of Better Systems and Training

Integrated billing platforms, automated pre-bill scrubs, and role-specific training reduce human error. Invest in encoder updates, payer-rule libraries, and regular staff competency assessments to improve first-pass acceptance rates.

Best Practices for Managing Hospital and Physician Billing

To run both institutional and professional billing efficiently, adopt these best practices:

- Clear Ownership Matrix: Define who bills for what in each episode of care (e.g., OR time = hospital; surgeon technical vs. professional split defined).

- Standardized Documentation Templates: Use EHR templates that capture both facility-level data and the clinician’s detailed notes required for CPT selection.

- Pre-Claim Scrubs: Automate NCCI and revenue-code edits in your clearinghouse to catch cross-claim errors.

- Continuous Education: Quarterly training on common payer edits (NCCI pairings, revenue code mapping, DRG logic) avoids repeated denials.

- Periodic Reconciliation: Reconcile hospital charges and professional claims post-discharge to ensure nothing was missed or double-billed.

- Outsource Smartly: If internal capacity is limited, a specialized partner can handle complex institutional billing rules and professional claims workflow.

Concluding Words

Understanding the difference between hospital and physician billing protects revenue, reduces denials, and strengthens compliance. Hospitals and physician groups must clearly separate facility vs provider charges, align coding and documentation, and use robust systems to manage claim submission.

If your practice needs help harmonizing professional and institutional workflows, Resilient MBS can help. Our medical billing services specialize in the end-to-end coordination of hospital and physician billing, reducing denials and shortening days in accounts receivable (AR) so your clinicians can focus on patient care.

FAQs

What is the main difference between hospital and physician billing?

Hospital billing (institutional billing) covers facility-related charges, room, supplies, imaging, and labs, and is submitted on a UB-04. Physician (professional) billing covers the clinician’s services, E/M visits, procedures, and interpretations, and is submitted on a CMS-1500 form. Knowing this difference prevents duplicate billing and denials.

Which form should I use: UB-04 or CMS-1500?

Use UB-04 (CMS-1450) for institutional/hospital claims and CMS-1500 for professional/physician claims. The form choice depends on who provided the service (facility vs provider) and what the payer’s rules require.

Can both the hospital and the doctor bill for the same patient visit?

Yes, but only for distinct items. The hospital bills for facility resources (e.g., OR time, room charges) while the physician bills for professional services (e.g., surgery, consult). Clear documentation and proper modifiers prevent double-billing and payer edits.

What common errors cause denials when handling hospital and physician billing?

Frequent errors include using the wrong claim form, placing facility charges on a professional claim (or vice versa), incorrect CPT vs revenue code mapping, and missing modifiers. These mistakes often lead to denials and delayed payment.

When should I consider outsourcing hospital or physician billing?

Consider outsourcing when denial rates or days-in-AR remain high, internal staff can’t keep up with payer complexity, or you need specialized institutional billing expertise (e.g., DRG optimization). A specialized partner can reduce denials and improve cash flow.