In medical billing, not all payment adjustments are the same, especially when it comes to refunds and recoupments. These two terms are often confused, but they mean very different things. Knowing the difference can help healthcare providers avoid mistakes, stay compliant with rules, and build trust with patients and insurance companies.

In this blog, we’ll explain the Difference Between Refund and Recoupment, how they work, and why understanding them is important for smooth and accurate billing.

What Is a Refund in Medical Billing?

A refund in medical billing refers to the return of funds to the insurance company or patient when an excessive amount was paid for a medical service. This usually occurs when the doctor or clinic receives more money than they should have for a specific treatment or visit.

Common Reasons for Refunds

- Patient Overpayment: Sometimes, patients pay too much at the time of service because of confusion about their insurance, deductibles, or co-pays.

- Insurance Overpayment: Insurance companies might pay more than they should because of errors like duplicate payments or wrong coordination of benefits.

- Eligibility Issues: If the patient didn’t have active insurance on the date of service, and a payment was made, it may need to be returned.

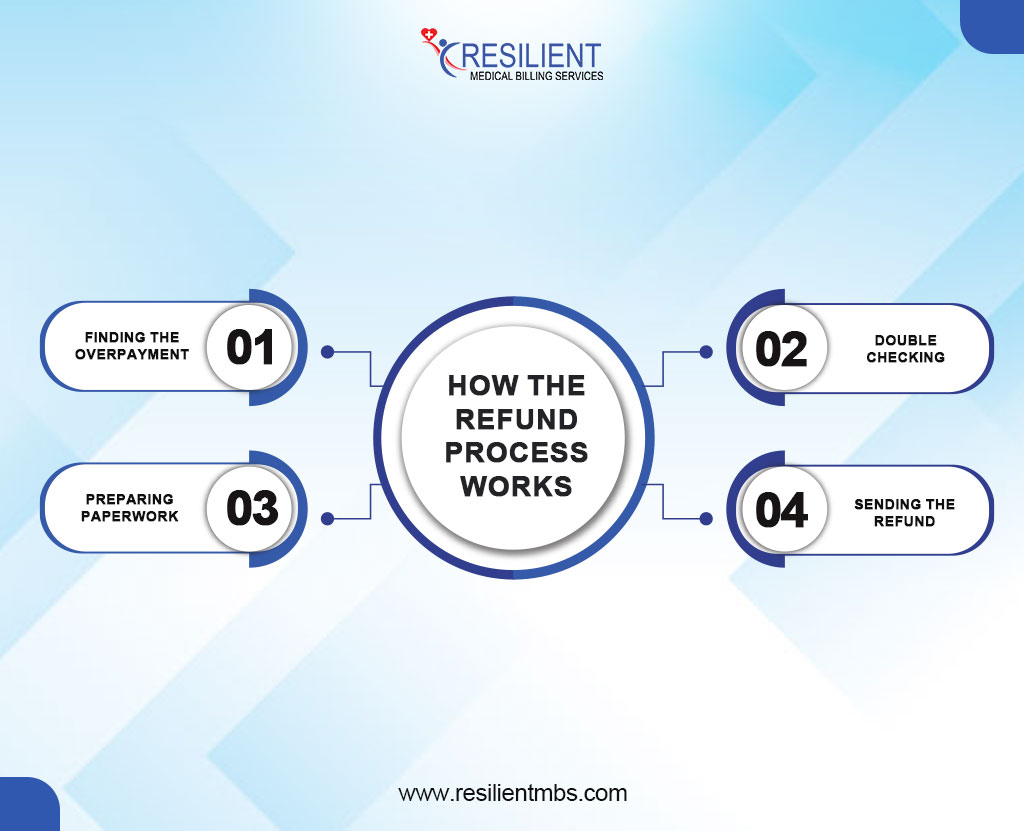

How the Refund Process Works

Finding the Overpayment: The billing team spots the overpayment through reviews, insurance notices, or payment reports.

Double-Checking: They check medical records and billing details to make sure a mistake was not made.

Preparing Paperwork: All required documents are gathered, like refund forms, insurance explanations (EOBs), and payment history.

Sending the Refund: The money is returned to the right person (either the patient or the insurance), and the records are updated.

What Is Recoupment in Medical Billing?

Recoupment Definition

Recoupment in medical billing happens when an insurance company or government health program takes back money it paid to a healthcare provider by mistake. These mistakes can happen due to things like wrong medical codes, duplicate claims, or if the patient wasn’t eligible for coverage at the time of service.

For example, if a patient wasn’t covered when they got treatment, the insurance company might realize the payment was incorrect. Instead of asking the provider to send the money back, the insurer often uses a method called offset—this means they take the overpaid amount out of future payments they owe the provider.

While recoupment helps insurance companies fix payment errors, it can cause problems for providers. It may affect their cash flow and make it harder to manage their finances.

That’s why providers need to use accurate billing practices and regularly check communications from payers to avoid surprises and stay in control of their revenue.

Understanding the Difference Between Refund and Recoupment in Medical Billing

Knowing the difference between a refund and a recoupment helps healthcare providers avoid confusion and stay on top of their finances.

Who Starts the Process

A refund is started by the provider. This usually happens when they notice they were paid too much, maybe because of a billing mistake or a duplicate payment—and they return the extra money.

A recoupment is started by the insurance company or payer. This happens when they find an overpayment during a review and take steps to get the money back.

Voluntary vs. Involuntary

- Refunds are voluntary if the provider chooses to return the money.

- Recoupments are involuntary; the payer takes the money back, often without asking the provider.

How and When It’s Done

- Refunds follow the provider’s process and any rules set by the payer.

- Recoupments follow the payer’s timeline and are often handled by taking money out of future payments to the provider.

Communication and Paperwork

- With a refund, the provider usually sends the money back with an explanation.

- With a recoupment, the payer sends a formal notice. Providers may have only a short time to respond or appeal.

Why It Matters

Understanding how refunds and recoupments work can help providers avoid problems, stay compliant with rules, and keep their finances in order.

Claims Overpayment Recovery – Refund or Recoupment?

Sometimes, healthcare providers get paid more than they should, either by the patient, the insurance company, or both. This is called an overpayment. It can happen because of things like billing mistakes, wrong medical codes, or errors by the insurance company.

There are two main ways to handle overpayments:

Refunds: The provider notices the extra payment and sends the money back to the payer.

Insurance Recoupments: The insurance company finds the overpayment and takes that amount out of future payments to the provider. This is also called an offset.

Both refunds and recoupments have rules. Providers must return overpayments within a certain time or risk penalties. Not handling recoupments correctly can lead to problems with insurance companies and future payments.

Offset in Medical Billing

An offset in medical billing happens when an insurance company takes back money it overpaid by reducing the payment on a future claim. Instead of asking the healthcare provider to send the money back, the insurer simply pays less on the next bill.

For example, if a provider overpaid $150 on a past claim, the insurance company may take $150 out of the payment for a new claim to make up the difference.

This process is called an offset because the overpayment is “offset” by lowering future payments. While it helps insurance companies recover money quickly, it can create confusion or affect the provider’s cash flow if not monitored closely.

To stay on top of offsets, billing staff should always review payment details and explanation of benefits (EOBs) carefully.

Let Resilient MBS be your trusted partner in medical billing excellence.

Tips for Managing Refunds and Recoupments

Bill Accurately

Double-check coding, insurance eligibility, and patient information. Regular audits help catch mistakes before claims are sent.

Act Quickly on Overpayment Notices

If you get a notice about an overpayment, respond quickly to show you’re following the rules and to avoid bigger problems.

Keep Good Records

Track all refunds, recoupments, and payment adjustments. Use billing software to stay organized.

Know the Rules

Each insurance company has its policies. Stay updated and make sure your billing staff knows how to follow them.

Closing Thoughts!

Knowing the difference between refunds and recoupments helps keep your medical practice financially healthy and in line with rules. Both deal with overpayments, but they happen in different ways; one is started by the provider, the other by the payer.

By sending correct claims and quickly fixing any overpayment issues, you can avoid problems and keep your billing running smoothly.

Need help managing overpayments? Resilient MBS is here to support you with clear and reliable solutions.

FAQS

What’s the difference between a refund and a recoupment in medical billing?

A refund happens when a provider sends money back after being overpaid. A recoupment is when the insurance company takes back money it believes was paid by mistake.

Who starts the refund or recoupment process?

Usually, the provider starts a refund. A recoupment is started by the insurance company or payer.

What does “offset” mean in medical billing?

An offset means the insurance company takes back money it overpaid by reducing future payments to the provider.

Why would an insurance company take back money (recoupment)?

This can happen if they find billing mistakes, incorrect codes, or realize the patient wasn’t covered.

How can providers avoid refunds and recoupments?

By checking insurance details, billing correctly, and fixing any issues quickly, providers can avoid many refund and recoupment problems.