A medical coding audit helps ensure your documentation and codes are accurate, compliant, and optimized for reimbursement. Coding errors are somehow costly, leading to 80% of medical bills containing mistakes, and claim denial rates can reach 20% for some providers.

Regular audits reduce denials, improve compliance, and strengthen your revenue cycle. Whether handled internally or by professionals, medical coding audits are essential to protecting both income and reputation.

In this blog, we’ll discuss the different types of medical coding and audits, their key benefits, and best practices to ensure coding accuracy and financial integrity.

Types of Medical Coding Audits

Medical coding audits can be broadly classified into two main types:

- Prospective audits

- Retrospective audits

Each offering has distinct benefits and suitable use cases.

Prospective Audits

Prospective audits are performed before submitting medical claims to payers. They review medical records and coding decisions in advance to catch errors early in the revenue cycle.

These audits are especially beneficial when onboarding new providers, adopting new coding systems (like ICD-10 updates), or launching new services. They help maintain high coding standards and prevent costly mistakes.

Retrospective Audits

Conducted after claim submission, these audits assess coding accuracy and identify issues like denials, underpayments, or compliance risks. They help spot trends such as upcoding or unbundling and offer valuable insights for coder training and revenue recovery.

Further Types Of Medical Coding Audits

Random Audits

These audits review a sample of claims without predefined criteria, offering an unbiased view of overall coding practices. Regular random audits serve as a proactive quality control tool, helping detect systemic issues early.

Focused Audits

Focus audits on Target-specific problem areas, such as high-risk providers or services with frequent denials. They often use checklists to verify coding accuracy, documentation, and modifier use. Focused audits refine department policies and training efforts.

External vs. Internal Audits

Internal audits are conducted by in-house staff and are ideal for ongoing monitoring of medical coding practices. However, they may lack objectivity due to potential internal biases.

In contrast, external audits are performed by independent third parties, providing an unbiased and standardized review of coding accuracy and compliance.

These are especially valuable for high-risk or compliance-driven evaluations. Many healthcare organizations adopt a hybrid approach, utilizing internal audits for routine checks while reserving external audits for annual reviews or addressing complex coding issues.

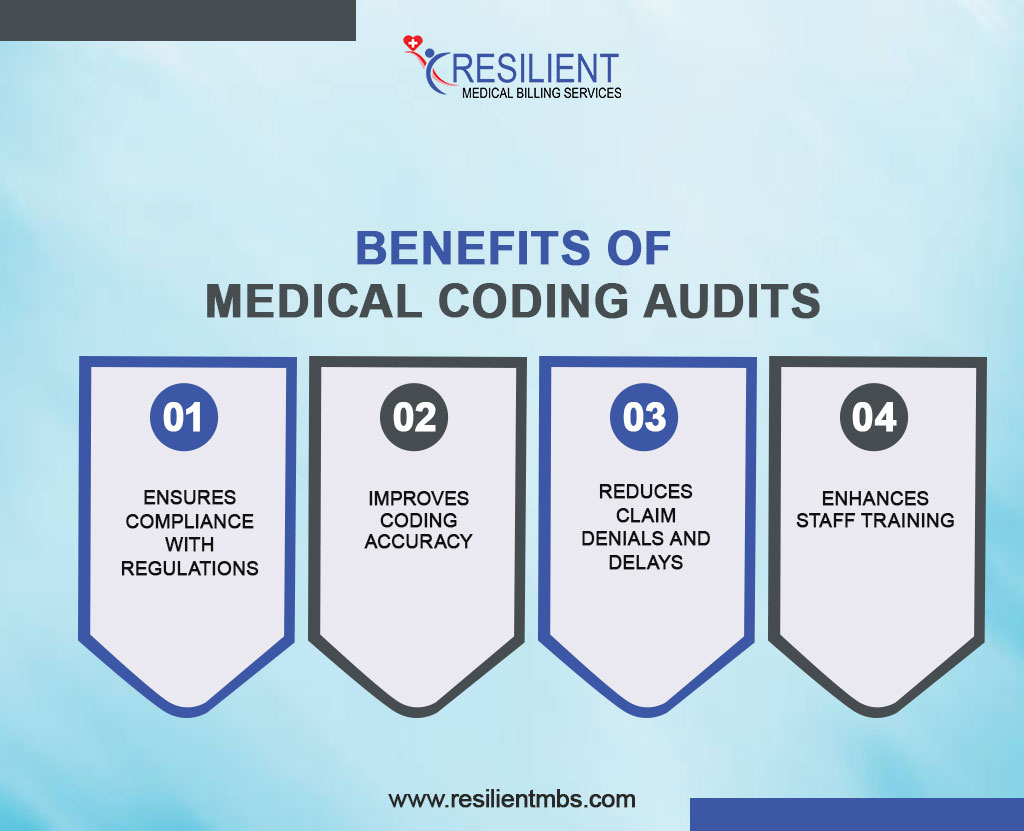

Benefits of Medical Coding Audits

Medical coding audits are essential for healthcare organizations to ensure compliance, enhance revenue cycle efficiency, and maintain accurate documentation.

When done systematically, they help reduce financial risk and support ongoing quality improvement.

- Ensures Compliance with Regulations

Audits help healthcare providers stay compliant with CMS guidelines and payer policies by identifying issues like upcoding, unbundling, and billing errors, reducing the risk of penalties and external audits.

- Improves Coding Accuracy

By reviewing ICD-10, CPT, and HCPCS code assignments, audits enhance documentation integrity and ensure accurate billing that reflects the services provided.

- Reduces Claim Denials and Delays

Regular audits catch coding errors before submission, lowering denial rates and speeding up reimbursements. Resulting in improved cash flow and less administrative burden.

- Enhances Staff Training

Audit results highlight common mistakes and knowledge gaps, allowing for targeted training. This keeps staff current with coding standards and payer expectations, fostering a culture of accuracy and compliance.

Best Practices for Conducting a Medical Coding Audit

Healthcare providers should take a planned, organized approach to medical coding checks in order to get the best results out of them. Key best practices include:

- Use a Detailed Medical Coding Audit Checklist

A comprehensive checklist ensures consistency and thoroughness. It should cover code accuracy, modifier use, medical necessity, and payer compliance to guide auditors and prevent oversight.

- Set Audit Frequency and Scope

Conduct audits regularly, which are monthly, quarterly, or annually, based on organizational needs. Include random, focused, or retrospective audits to target high-risk areas and track performance trends.

- Partner with Professional Audit Services

Engaging external audit firms offers objective insights, expert knowledge, and current regulatory standards. This adds credibility, especially in payer disputes or internal reviews.

- Document Findings and Implement Corrective Actions

Record audit results, provide timely feedback to coding staff, and establish corrective action plans. Monitor these actions over time to improve and maintain coding accuracy and

compliance.

Wrap-up!

Medical coding audits are indispensable for modern healthcare organizations striving to enhance compliance, coding accuracy, and financial performance. Healthcare providers can decrease risk, denials, and staff improvement by using a proactive audit plan that includes random, focused, and retrospective reviews.

Better Financial Performance Through Effective Medical Billing Audits

Effective medical billing audits ensure accurate documentation and coding, maximizing reimbursements and minimizing revenue loss from under-coding or missed charges. Regular audits enhance financial performance and boost operational efficiency over time.

The addition of regular medical coding and auditing services to the daily operations not only improves the revenue cycle but also promotes a culture of accountability and excellence.

Healthcare organizations that make thorough medical coding audits a top priority are better able to follow difficult rules, make sure they get the right payments, and give their patients the best care possible.

Call Resilient MBS today to get professional medical coding audit services that can help you improve your coding accuracy, stay compliant, and preserve your revenue cycle.