No one likes surprise medical bills. That’s why VOB in Medical Billing, short for Verification of Benefits (VOB), is essential. A proper VOB check gives everyone a clear picture of insurance coverage before treatment starts, helping providers avoid denied claims and patients understand their out-of-pocket costs.

In this blog, we’ll break down what VOB really means, how it’s different from a simple eligibility check, and why it’s the foundation of fair and transparent billing.

What is VOB in Medical Billing?

Verification of Benefits (VOB), or the meaning of VOB in medical billing, is more than just an eligibility check. It confirms whether a patient’s plan is active and digs deeper to identify covered services, co-pays, deductibles, prior authorization requirements, and network status.

Eligibility Check vs. VOB

Eligibility Check: Confirms the plan is active.

VOB: Confirms what the plan actually covers, what the patient will owe, and whether prior approvals are needed.

Why Verification of Benefits (VOB) Matters

A good VOB process in medical billing prevents denied claims, speeds payments, and reduces patient surprise bills.

- Fewer billing problems: Accurately checking benefits means fewer denials.

- Clear patient costs: Patients see co-pays, deductibles, and out-of-pocket estimates ahead of care.

- Better trust and experience: Transparent costs build patient confidence.

- Smoother revenue cycle: Less rework and faster cash flow lead to healthier finances.

Steps Of the VOB Process In Medical Billing

- Collect patient and insurance details: Record basic information such as name, date of birth, and insurance ID.

- Check with the insurance company: Staff confirmed details through calls, online portals, or electronic systems.

- Review coverage information: Services covered, co-pays, deductibles, and exclusions are verified.

- Look for special requirements: Some treatments need prior approval or a referral, which must be confirmed.

- Record everything clearly: Verified details are documented to avoid mistakes and help explain costs to patients.

- Spot issues early: Problems like expired policies or limited coverage are identified before treatment.

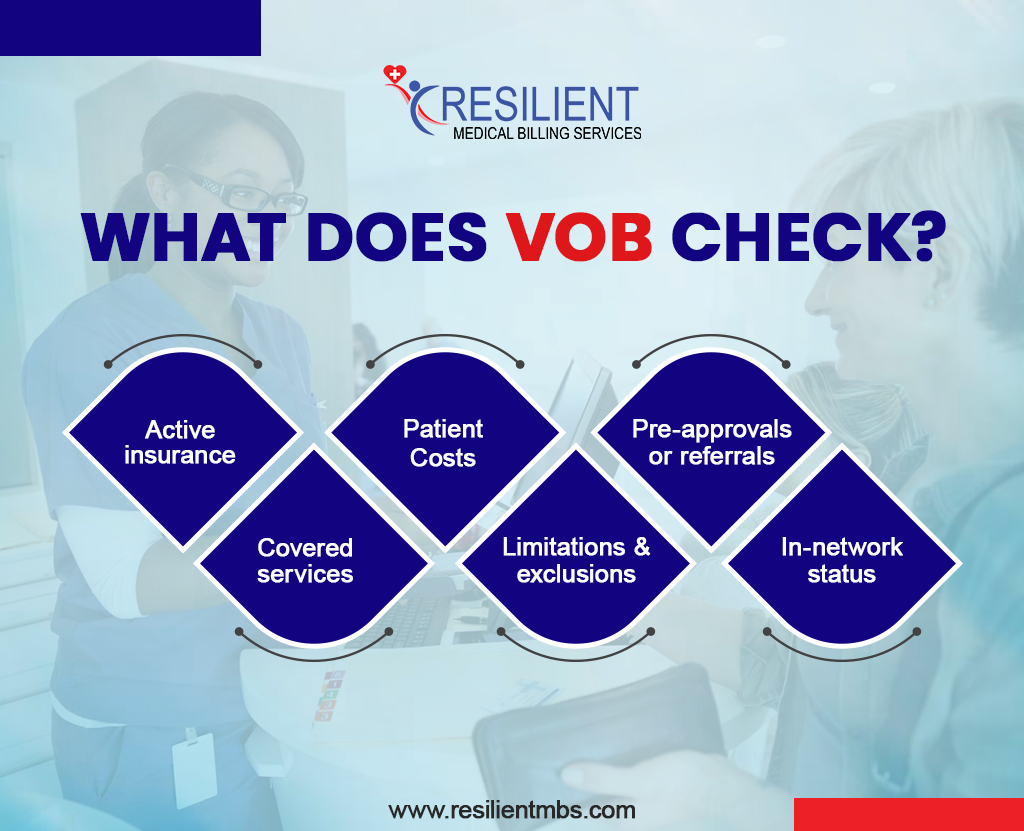

What Does VOB Check?

- Active insurance: Confirms the patient’s policy is active on the day of service.

- Covered services: Checks if the treatment or procedure is included in the insurance plan.

- Patient costs: Find out co-pays, deductibles, or co-insurance so patients know what they’ll pay.

- Limitations and exclusions: Identifies services the insurance won’t cover.

- Pre-approvals or referrals: Confirm whether certain services require approval before being provided.

- In-network status: Verifies whether the provider is in-network, which typically results in lower costs for patients.

Common Problems in VOB

Even good processes can hit snags: long insurance hold times, inconsistent answers from representatives, frequent policy changes, data-entry mistakes, and rushed VOBs, all of which can lead to denied claims.

- Long wait times with insurance companies.

- Different answers depending on which insurance representative you talk to.

- Frequent policy changes that are hard to keep up with.

- Simple mistakes in patient or insurance details cause claim denials.

- Rushed or skipped VOB, leading to denied claims and unexpected bills.

Tip: A robust verification workflow is the best way to make sure VOB catches issues before they become rework.

Benefits Of VOB

- Prevents claim denials and lost revenue.

- Reduces surprise bills for patients.

- Improves communication across care teams and payers.

- This system supports smooth VOB operations across the revenue cycle.

Best Practices for Effective VOB

A strong VOB process helps avoid billing problems and keeps patients informed.

Here are some simple steps providers can follow:

- Start early: Check benefits before the appointment. This confirms coverage, gives patients a clear idea of costs, and prevents delays.

- Use technology: Automated tools make the process faster, more accurate, and less prone to mistakes.

- Train staff: Insurance rules can be complex and challenging. Trained staff can explain coverage clearly and make sure nothing important is missed.

- Follow a checklist: Using a checklist ensures details like eligibility, co-pays, and covered services are always verified.

- Double-check big procedures: Surgeries and expensive treatments should always be verified carefully to avoid surprise bills.

- Stay organized: Clear processes, regular training, and good communication with insurers help everything run smoothly.

How Technology is Improving the VOB Process

Automated platforms and AI now pull payer data faster, log responses, and flag inconsistencies, reducing manual effort and human error. When VOB tools integrate with scheduling and EHRs, teams share a single source of truth, and claims move faster.

When VOB is connected to a practice’s scheduling, billing, and patient records, all departments can share the same up-to-date information, avoiding confusion and delays.

Digital platforms also make verification easier by giving real-time updates, tracking insurance responses, and keeping clear records. This not only reduces errors but also helps providers get claims approved more quickly.

If verifying benefits is slowing down your practice, our medical billing services at Resilient MBS handle thorough VOB checks, reduce denials, and clarify patient costs, allowing your staff to focus on care.

The Role of VOB in Preventing Billing Issues

A strong VOB workflow prevents denied claims and surprise bills by verifying coverage, cost sharing, and authorizations before care starts. That translates into fewer appeals, faster collection, and improved patient satisfaction.

By doing this, providers avoid claim denials and payment delays, while patients get a clear idea of their costs upfront.

In short, a strong VOB process makes billing smoother, prevents surprise bills, and helps both patients and providers feel more secure.

Why Strong VOB Processes Help Everyone

Verification of Benefits (VOB) is important for providers, patients, and insurance companies.

For Providers

Checking coverage details before care means fewer denied claims, faster payments, and less paperwork. This helps providers avoid financial stress and focus more on patient care.

For Patients

When patients know their costs upfront, there are fewer surprise bills. This makes it easier for them to plan, feel confident, and make better healthcare decisions.

For Insurance Companies

Clear benefit verification reduces confusion, speeds up claims, and prevents disputes with providers. This makes the billing process smoother for everyone.

Why Many Providers Outsource VOB

Outsourcing to specialized teams speeds verification, reduces mistakes, and gives practices more time to care for patients.

Benefits of Outsourcing

- Staff trained on payer rules

- Faster, more accurate verifications via automation

- Lower error rates and fewer claim rejections

- Small clinics regain staff time; large clinics scale without hiring

Concluding Words!

A strong verification program is the foundation of revenue integrity. If your practice needs help scaling verifications or reducing denials, professional medical billing services can deliver accurate VOB checks and better financial outcomes.

Contact Resilient MBS to learn how our verification workflow and billing expertise improve accuracy and speed collections.

FAQs

What does VOB mean in medical billing?

VOB stands for Verification of Benefits, which confirms what a payer will cover and the patient’s estimated share before billing.

How does the VOB process in medical billing work?

Collect patient info → contact payer/portal → confirm covered services, co-pays, deductibles, and authorization needs → document results.

Why is Verification of Benefits (VOB) important?

It reduces denied claims, speeds payment, and prevents surprise medical bills.

What are some best practices for effective VOB?

Start verification early, use automated tools, train staff, follow a checklist, and double-check costly services.

How does VOB catch issues before billing?

VOB flags expired policies, uncovered services, missing pre-authorizations, and network mismatches, ensuring corrections occur before claims are submitted.