The healthcare system relies heavily on accurate medical billing to ensure proper payment for services rendered, and understanding what is a superbill and how plays a crucial role in this process. Medical billing tools are essential in the medical field, as they help reduce errors that can lead to denied claims and financial losses.

A superbill is a key document in medical billing, summarizing all diagnoses, procedures, and other types of patient care information. Healthcare providers use this document during service delivery, particularly when seeking payment from insurance companies or directly billing the patient. By providing a comprehensive summary, a superbill ensures that all necessary information is included for accurate claims processing.

Billing errors are a significant issue, causing 30% of denied claims. According to the American Medical Association (AMA), these errors and inefficiencies cost the average healthcare practice 5-10% of its revenue annually. Understanding what a superbill is can help patients and healthcare providers address these billing issues and enhance accuracy.

By accurately completing and utilizing superbills, healthcare providers can streamline the billing process, reduce errors, and improve the overall efficiency of their practice. This not only helps in securing timely payments but also in maintaining a smooth operation within the healthcare system.

Why Are Superbills Essential?

Consider your superbills the keys to insurance reimbursements. Understanding a superbill for insurance is vital because your insurance company will not reimburse mishandled or disregarded superbills. Patient losses from wrongly submitted superbills exceed $50 billion annually!

See what proportion of out-of-network services your insurer covers through coinsurance on your plan’s website. After meeting your OON deductible, you may receive 80% reimbursement!

People often waste money because they need to understand their insurance covers numerous OON services. Without wanting such a thing to happen to you, reviewing the sample superbill is essential for medical billing services.

How Superbill Works In HealthCare Billing

Here’s how a Superbill works in healthcare billing:

1. Components of a Superbill

A Superbill typically includes:

- Provider Information

- Patient Information

- Date of Service

- CPT Codes

- ICD-10 Codes

- Service Descriptions

- Charges for Each Service

2. Patient's Role

The patient submits the Superbill to the insurance company for payment after obtaining it from the healthcare provider. The patient must verify the Superbill’s accuracy and completeness.

3. Insurance reimbursement

The insurance company evaluates the Superbill to determine coverage and reimbursement. This method checks that the patient’s insurance covers the services and the correct codes

4. Reimbursement Process

After approval, the insurance company reimburses the patient. Insurance plans, deductibles, co-payments, and coinsurance influence whether the patient receives full or partial compensation.

Why Does the Need for Superbill Creation Arise?

As healthcare billing becomes more complicated, the Superbill bridges the gap between providers and insurers.

Why create Superbills? What is a superbill? Discuss why this document is needed and how it benefits patients and providers.

1. Navigating Out-of-Network Providers

Superbills are often needed when patients see out-of-network doctors. Out-of-network providers charge patients upfront, unlike in-network doctors who bill insurance companies. Here comes the Superbill. Patients can submit a thorough receipt to their insurance company for payment.

2. Facilitating Transparency in Billing

Healthcare prices often need to be clarified. A Superbill lists all services and their costs. This transparency helps patients comprehend their bills and dispute billing anomalies. Accounting for every test, procedure, and consultation makes billing simpler and fairer.

3. Supporting Patients with High-Deductible Plans

More high-deductible health plans (HDHPs) have been introduced in recent years. Patients must pay a lot before their insurance kicks in with these plans. Superbills are essential for these patients since they list all deductible-approachable spending. Patients can track their healthcare spending and see how close they are to hitting their deductible.

4. Aiding in Accurate Reimbursement Claims

Claims payment from insurers typically require detailed documentation. Superbills should include CPT and ICD-10 codes, which define medical procedures and diagnoses. The insurance company needs these codes to comprehend the care and decide compensation. With a Superbill, more payment information can be required to ensure payment information is received.

5. Simplifying Record-Keeping and Tax Documentation

Accurate records are crucial for patients and healthcare providers. Medical expenses might be documented with superbills for tax considerations or future medical requirements. They help patients track their healthcare journey and costs to have all the essential documents for taxes or medical history.

What Are the Types of Superbills?

1. Client-Submitted Superbills

These are provided to patients by their healthcare provider. Patients submit Superbill to insurance companies for payment. Patients who use out-of-network physicians and request reimbursement directly often experience this.

2. Clinician-Submitted Superbills

Some healthcare providers or clinics submit Superbills directly to insurance companies on behalf of patients. In out-of-network billing procedures, this is rare but may be offered.

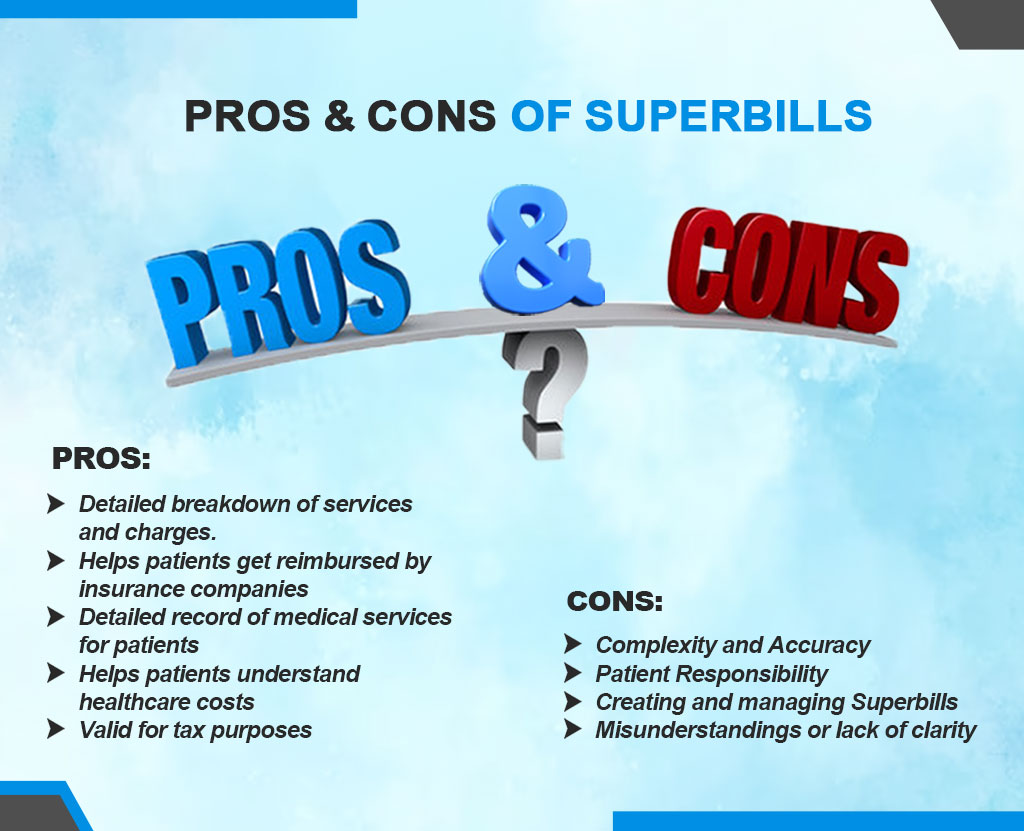

Pros and Cons of Superbills

Pros

- Provides a clear and detailed breakdown of services rendered and associated charges.

- Helps patients get reimbursed by insurance companies for out-of-network services.

- It serves as a detailed record of medical services for patients and providers and helps track medical history and expenses.

- Allows patients to understand their healthcare costs better and navigate the insurance reimbursement process.

- Valid for tax purposes, as it provides a record of healthcare expenses that may be tax-deductible.

Cons

- Complexity and Accuracy

- Patient Responsibility

- Creating and managing Superbills

- Misunderstandings or lack of clarity

Superbill Reimbursement

How Superbills are Used for Reimbursement Purposes

Healthcare providers send patients detailed superbills listing services rendered. They help when providers don’t bill the insurer directly. Instead, patients use superbills to get insurance payments. These documents contain important information on the provider, patient, services, and medical codes like CPT and ICD-10. According to their insurance plan, superbills can reimburse patients partially or fully for medical expenses.

The Process for Patients to Submit Superbill to Insurance Companies

Submitting a superbill for reimbursement involves a few steps:

- Collect the Superbill

- Review the Superbill

- Submit the Superbill

- Follow-Up

Superbill for Therapy

Therapists provide clients with comprehensive papers called superbills after sessions. It contains all the information the client needs to file a claim with their insurance carrier and get their money back. This document lists the therapist, client, service dates, types, and costs. It may also provide diagnostic and treatment codes that insurance companies need to process claims. Superbill for behavioral health therapy provides refunds to insurance customers who receive out-of-network treatment.

Benefits of Using Superbills for Therapy Services

Using superbills for therapy offers several benefits:

- Financial Transparency

- Insurance Reimbursement

- Flexibility in Provider Choice

- Empowerment