Getting paid isn’t the only reason for accurate medical billing; it’s also important for keeping the healthcare system working efficiently for both patients and providers. The circumstances can get confusing quickly when a lot of people have more than one insurance plan. That is where Coordination of Benefits (COB) comes in.

COB lets insurance companies work together to figure out who pays first and how much the second plan covers. This keeps claims from being denied, delayed, or confused.

This blog will define coordination of benefits in medical billing, explain its role in the healthcare reimbursement process, and highlight why it is essential for healthcare providers, insurers, and patients.

Define Coordination of Benefits in Medical Billing

To define coordination of benefits in medical billing it refers to the process by which multiple health insurance plans work together to determine the order in which they will pay for a patient’s medical expenses. This process prevents duplicate payments and ensures that the total payment does not exceed the actual cost of care.

The primary goal of Coordination of Benefits (COB) is to simplify healthcare reimbursement by assigning a primary and secondary payer. This helps prevent overpayments, reduce errors, and ensure efficient claims processing.

COB safeguards patients, providers, and insurers by promoting accuracy and transparency when multiple insurance plans are involved.

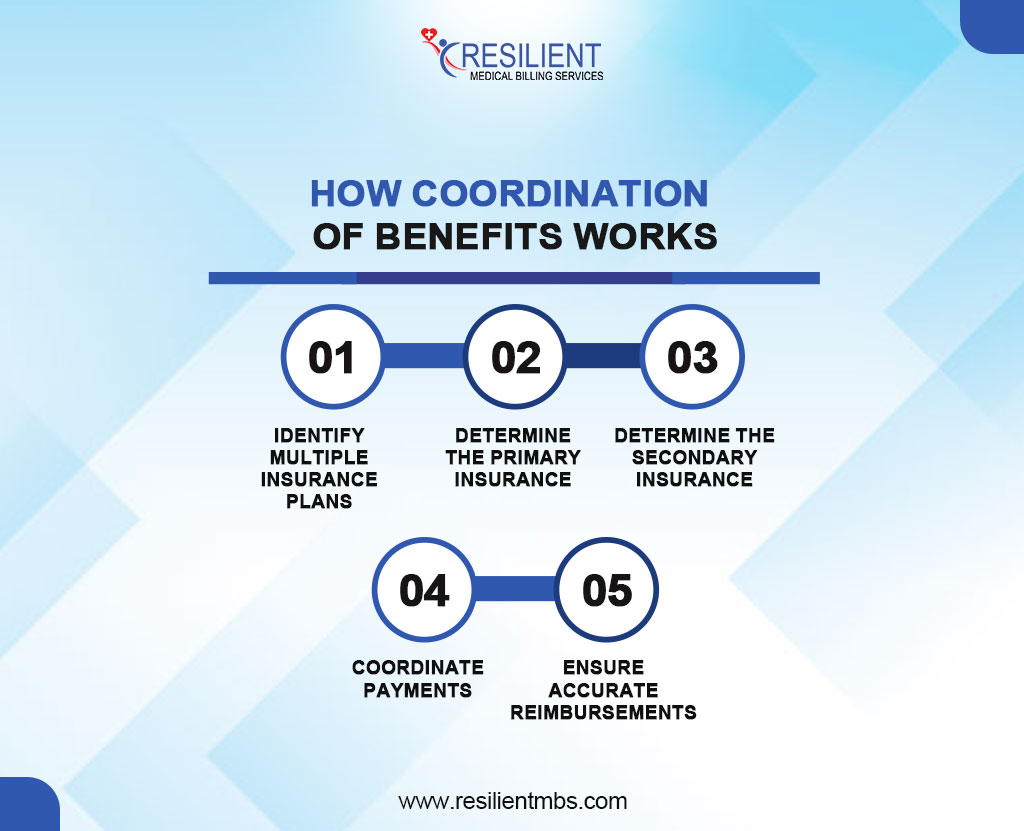

How Coordination of Benefits Works

1. Identify Multiple Insurance Plans

COB applies when a patient is covered by more than one health insurance policy.

2. Determine the Primary Insurance

The primary insurer pays first. It is usually identified based on:

- Employment status

- The birthday rule (for dependent children)

- Court orders (in cases of divorce)

3. Determine the Secondary Insurance

The secondary plan covers remaining eligible costs, such as co-pays, deductibles, or co-insurance, only if those services are covered by the plan.

4. Coordinate Payments

COB ensures payments are split correctly between insurers, avoiding:

- Duplicate payments

- Overpayments

- Claim denials due to confusion

5. Ensure Accurate Reimbursement

The total payment from both insurers cannot exceed the actual cost of care. This protects patients, providers, and insurers by:

- Reducing billing errors

- Improving transparency

- Promoting efficient healthcare reimbursement

Coordination of Benefits in Health Insurance

Coordination of Benefits (COB) ensures accurate claims processing when a person is covered by more than one health insurance plan common among married couples, children with coverage from both parents, or individuals with both employer-sponsored insurance and Medicare.

Spouses with Employer Plans: The plan of the spouse receiving care is typically the primary payer.

Dependent Children: The “birthday rule” applies to the parent whose birthday falls earlier in the calendar year who holds the primary plan.

Divorced or Separated Parents: Custody arrangements and court orders determine which plan is primary.

Medicare and Other Coverage: Medicare’s role as primary or secondary payer depends on factors like employer size and active employment status.

A well-managed COB process reduces out-of-pocket expenses, minimizes claim denials, and ensures compliance and financial accuracy in healthcare billing.

Coordination of Benefits for Medicare

Coordination of Benefits (COB) for Medicare ensures that medical claims are paid correctly when a beneficiary is covered by more than one insurance plan. The process identifies which insurer is the primary payer (pays first) and which is the secondary payer (covers remaining eligible costs).

Medicare usually pays for everything when it is the only type of coverage the person has. But when there is more than one type of insurance, such as employer-sponsored plans, retiree insurance, or Medicaid, Medicare’s role changes based on certain requirements. For instance:

- If an individual is over 65 and actively working with employer coverage, the employer plan usually pays first.

- For those with retiree coverage, Medicare is generally the primary payer.

- In cases involving Medicaid, Medicare always pays first.

Medicare COB – Special Considerations

- Understand Medicare’s Role

Medicare can act as either the primary or secondary payer, depending on the patient’s insurance situation.

- Primary Payer Scenarios:

Medicare is usually the primary payer when the individual:

- Has no other health insurance

- Is retired and only covered by Medicare

- Secondary Payer Scenarios

Medicare becomes the secondary payer when the patient:

- Has employer-sponsored insurance (self or spouse)

- It is covered by workers’ compensation

- Receives benefits from liability or no-fault insurance

- Verify Coverage Regularly

Always confirm a patient’s current insurance status to apply the correct COB rules.

- Document Insurance Details Accurately

Ensure all insurance information is current and recorded correctly to prevent claim denials.

- Avoid Reimbursement Issues

Applying incorrect COB rules can lead to delays, denials, or underpayment, affecting both providers and patients.

- Stay Updated on Medicare Guidelines

Billing professionals must keep up with changing Medicare COB regulations to ensure compliance and timely payments.

Common COB Challenges in Medical Billing

- Inaccurate or Outdated Insurance Information

Incorrect or outdated details about a patient’s primary and secondary insurance can lead to claim denials or delays. These errors often stem from a failure to regularly verify and update insurance records.

- Private Insurance and Medicare/Medicaid Conflicts

Coordination issues frequently occur when both private insurance and Medicare or Medicaid are involved. Misreporting or miscommunication between payers can cause confusion over which plan is primary, leading to rejected claims.

- Claim Denials Due to Improper Billing

When Medicare is incorrectly billed as the primary payer instead of secondary (or vice versa), claims may be denied entirely, requiring resubmission and delaying reimbursement.

- Financial and Administrative Impact

These COB challenges burden healthcare providers with administrative work and delayed payments. Patients may also suffer financial strain from denied claims or unexpected bills.

- Need for Proactive COB Management

To minimize problems and make sure that bills are accurate and on time, it’s important to check insurance coverage often, keep patient records up to date, and know the regulations for COB.

Best Practices for Managing Coordination of Benefits (COB)

Efficient COB management is key to reducing claim denials and improving reimbursement timelines. Implement these best practices to ensure accuracy and timeliness:

- Verify Coverage at Every Visit

Insurance details can change frequently due to employment, Medicare eligibility, or family status. Verifying coverage at each visit helps prevent incorrect COB assignments and delays.

- Keep Insurance Information Updated

Ensure patient records reflect accurate primary and secondary insurance details. Confirm policy numbers, plan types, and coordination status to avoid claim rejections.

- Use Billing Software and Payer Portals

Leverage billing tools and payer portals to automate COB processes. These systems flag errors, track missing details, and provide real-time updates on coordination rules for faster, more accurate claim submission.

Why Coordination of Benefits Is Essential for Healthcare Providers, Insurers, and Patients

When more than one insurance plan is involved, Coordination of Benefits (COB) is very important for making sure that healthcare payments are correct and swift. For healthcare providers, COB reduces claim denials, minimizes payment delays, and supports smoother revenue cycle management. Accurate payer order ensures they receive correct reimbursement without administrative burdens.

For insurers, COB helps prevent overpayments and duplication of benefits, maintaining financial integrity and compliance with regulatory standards.

For patients, COB reduces out-of-pocket costs, avoids billing confusion, and ensures claims are processed promptly. It also helps prevent coverage gaps and surprise medical bills.

Effective COB promotes transparency, reduces errors, and benefits all stakeholders in the healthcare system.

Wrap-Up!

Coordination of Benefits (COB) is essential for accurate reimbursements and a smooth revenue cycle in multi-payer healthcare settings. By routinely verifying insurance, maintaining up-to-date records, and leveraging technology, providers can minimize claim denials and delays.

A strong, proactive COB strategy not only accelerates payments but also enhances patient trust by reducing billing confusion and unexpected charges, making it a vital component of modern healthcare management.

Providers who want to improve their Coordination of Benefits operations could truly benefit from experienced guidance and the right resources. Working with skilled medical billing professionals makes sure that everything is done correctly, cuts down on paperwork, and speeds up payments.

Contact Resilient MBS today to learn how our expert billing solutions can simplify your COB processes and maximize your revenue cycle performance.