Medical billing denials can be frustrating, as they slow down payments and create extra work for your team. One code that frequently appears is CO 5. Understanding it is key to keeping your revenue flowing smoothly. In this blog, we’ll break down what the CO 5 denial code means, why it happens, and how you can fix it quickly and prevent it in the future.

What is the CO 5 Denial Code?

The denial code CO 5 stands for a Contractual Obligation, indicating that a claim has been denied because “The procedure code/bill type is inconsistent with the place of service.” However, in most payer systems, CO 5 more commonly refers to:

Co-5 Denial Code Description: “The claim is denied because the services are covered under another payer’s policy.”

This means the insurance provider has rejected the claim because the patient has other active coverage that should be billed as the primary insurance. It is a coordination of benefits (COB) issue where the billing was sent to the wrong payer, or the primary payer was not properly identified.

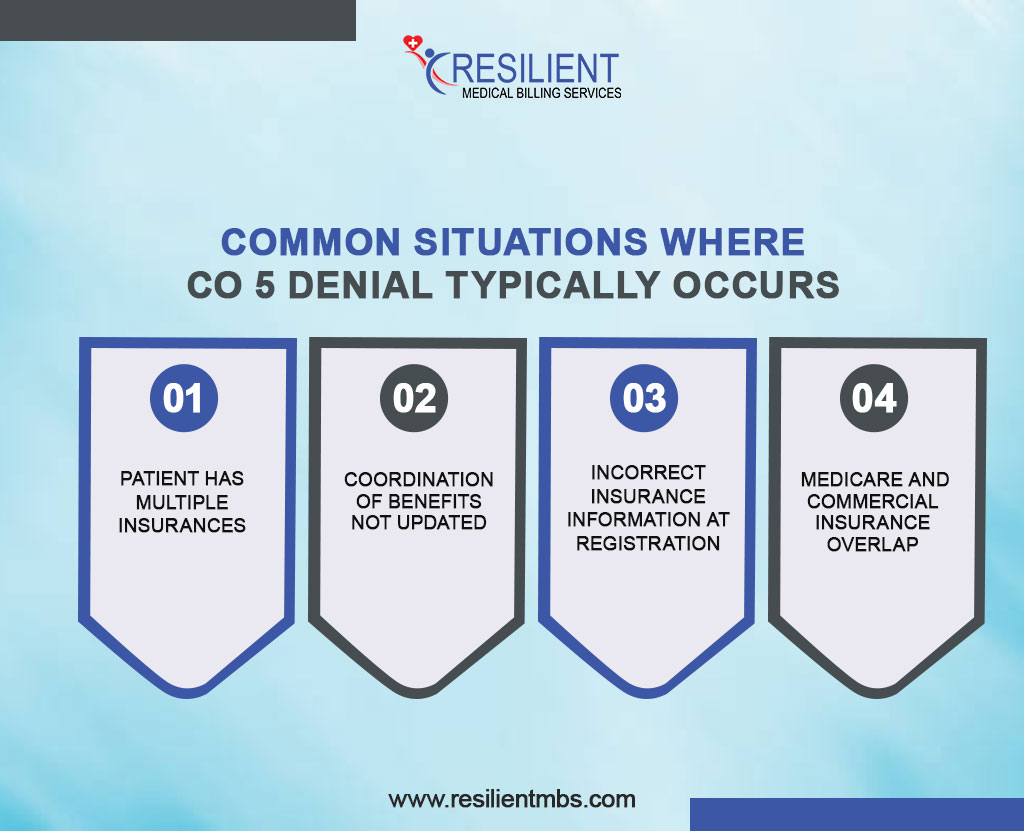

Common Situations Where CO 5 Denial Typically Occurs

- Patient Has Multiple Insurances: The patient is enrolled in more than one insurance plan, and the billing was incorrectly submitted to the secondary payer instead of the primary one.

- Coordination of Benefits Not Updated: The insurance provider’s records are outdated, and they are unaware of the patient’s current primary insurance.

- Incorrect Insurance Information at Registration: Front-desk errors during patient intake can result in inaccurate or missing payer data.

- Medicare and Commercial Insurance Overlap: For patients with both Medicare and another commercial plan, accurately determining the primary and secondary coverage is crucial to avoid CO-5 denials.

Proper identification and resolution of CO 5 denials can significantly reduce claim processing times and improve revenue recovery rates.

Common Reasons for CO 5 Denials

CO 5 denials occur due to problems in the Coordination of Benefits (COB) process between primary and secondary insurers, resulting in claim denials.

Here are the Common Reasons for CO 5 Denials:

- Confusion or miscommunication about which insurer is primary vs. secondary

- Submission of claims to the wrong insurer first

- Use of outdated, inactive, or missing insurance information

- Incorrect designation of primary and secondary insurance (e.g., billing the dependent’s plan instead of the employer’s)

- Late claim submissions are causing disruption in insurer coordination and the denial of secondary claims

Difference Between CO 5 and Other Similar Codes

To avoid confusion and implement appropriate corrective actions, it is essential to differentiate the CO 5 denial code from other commonly encountered codes, such as CO 6 and CO 4.

CO 5 vs. CO 6 (Procedure Code Not Covered)

CO 5 addresses insurance coordination issues—specifically, who should pay first.

CO-6 Denial code, on the other hand, indicates that the procedure code billed is not covered under the patient’s benefit plan.

Resolution: CO 5 requires verification and correction of coordination of benefits, whereas CO 6 demands reviewing the patient’s benefit coverage and possibly appealing for medical necessity or correcting the CPT/HCPCS code.

CO 5 vs. CO 4 Denial (Coverage Terminated)

CO 4 denotes that the insurance coverage has ended, and the claim was submitted for a date of service after the policy termination date.

CO 5 may still involve active policies, but with incorrect coordination between primary and secondary insurers.

Resolution: CO 4 necessitates obtaining updated insurance information or patient payment; CO 5 calls for clarification of the insurance order and possible claim resubmission with the correct payer.

How to Address a CO 5 Denial Code

A CO 5 denial means the claim was denied because a different primary payer covers the services. This usually happens due to errors or outdated Coordination of Benefits (COB) information. Resolving this requires a systematic approach.

Steps to Verify Patient Insurance Coverage

- Verify the patient’s insurance at every visit, including Medicare, Medicaid, commercial, and secondary plans.

- Use real-time eligibility tools or contact payers directly to confirm active policies.

- Check policy effective dates and for dual coverage.

- Document all payer communications in the patient’s record.

How to Determine the Correct Primary Payer

- Follow National Coordination of Benefits guidelines, which prioritize payers by coverage type (e.g., group plans often primary over Medicare).

- Consider factors like the policyholder’s employment, accident claims, and dependent coverage rules (e.g., the “birthday rule”).

- Review the patient’s Explanation of Benefits (EOB) and clarify with the patient if they have multiple plans.

Tips to Update COB (Coordination of Benefits) Information

In cases where COB data is outdated or missing, updating it promptly with the correct payer is essential.

Updating COB Data

When COB data is outdated or missing, promptly update it by:

- Contacting the insurance carrier to submit the latest COB information

- Asking the patient to contact their insurer if needed

- Documenting the date and time of updates for audit purposes

- COB updates may be done via secure portals, fax, or specific forms, depending on the insurer.

Resubmission and Appeals

- After correcting the COB data, resubmit the claim by:

- Rebilling with updated primary payer details

- Including all supporting documents (e.g., updated EOBs, COB confirmation)

- Using the correct claim frequency code (e.g., 7 for corrected claims)

If denied again, start a formal appeal with a detailed letter and relevant documentation. Always meet appeal deadlines to prevent claim expiration.

Best Practices to Prevent CO 5 Denials

- Train staff to collect full insurance details and confirm secondary coverage at registration.

- Use real-time verification tools to flag COB errors and coverage changes.

- Educate staff on COB rules and integrate verification into the EHR with automated reminders to ensure compliance.

Role Of Denial Management Team

A denial management team is vital for maintaining the financial health and efficiency of healthcare practices. Denial Code 5 is often caused by coordination of benefits (COB) errors, outdated insurance info, or communication gaps. Proactive action is essential to prevent revenue loss.

This team not only corrects denied claims but also identifies trends, streamlines workflows, and trains front-office staff on accurate data collection, thereby reducing recurrence and accelerating the revenue cycle.

Key Tools and Strategies Of the Denial Management Team

- Denial tracking software: Flags frequent, common denial codes, such as Code 5, for review.

- Eligibility verification tools: Automate insurance checks before services to minimize COB denials.

- EHR integration: Enhances data accuracy between clinical and billing teams.

- Root cause analysis targets the underlying reasons for denial to inform focused solutions.

- Staff training: Improves insurance verification and COB updates at intake.

These methods enhance denial resolution and minimize rework, thereby optimizing resource utilization.

Internal Audits and Performance Reviews

Regular audits identify systemic issues, such as coding errors or outdated policies, while performance reviews track metrics like first-pass acceptance and denial overturn rates. This ongoing evaluation ensures continuous improvement and accountability in denial management.

Final Words

Denial Code 5, which pertains to coordinating benefits, is a common issue in medical billing that can be avoided. It can take longer to get reimbursed, mess up cash flow, and put a strain on managerial resources. Checking for eligibility, having correct patient data, and training staff are all proactive steps that help stop denials, lower costs, and protect revenue.

Work With Experienced Billing Professionals

Partnering with skilled medical billing professionals or outsourcing denial management can significantly boost claim approval rates. These experts utilize proven strategies and tools to resolve denials, such as Code 5, efficiently, ensuring better reimbursements and long-term financial health.

For expert support in denial prevention and billing optimization, contact Resilient MBS LLC today. Let us make simpler income cycles and protect the bottom line of the business you run.